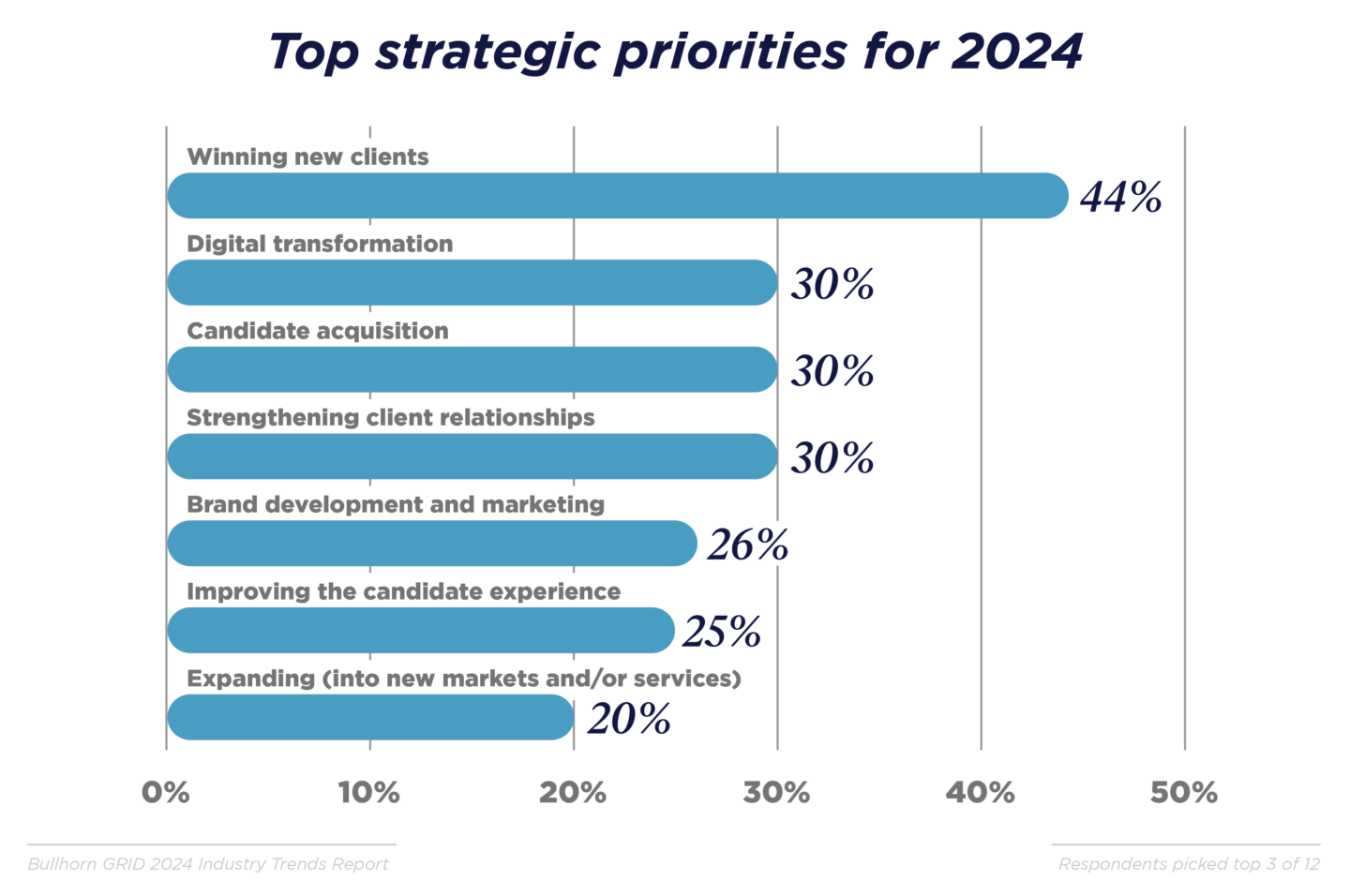

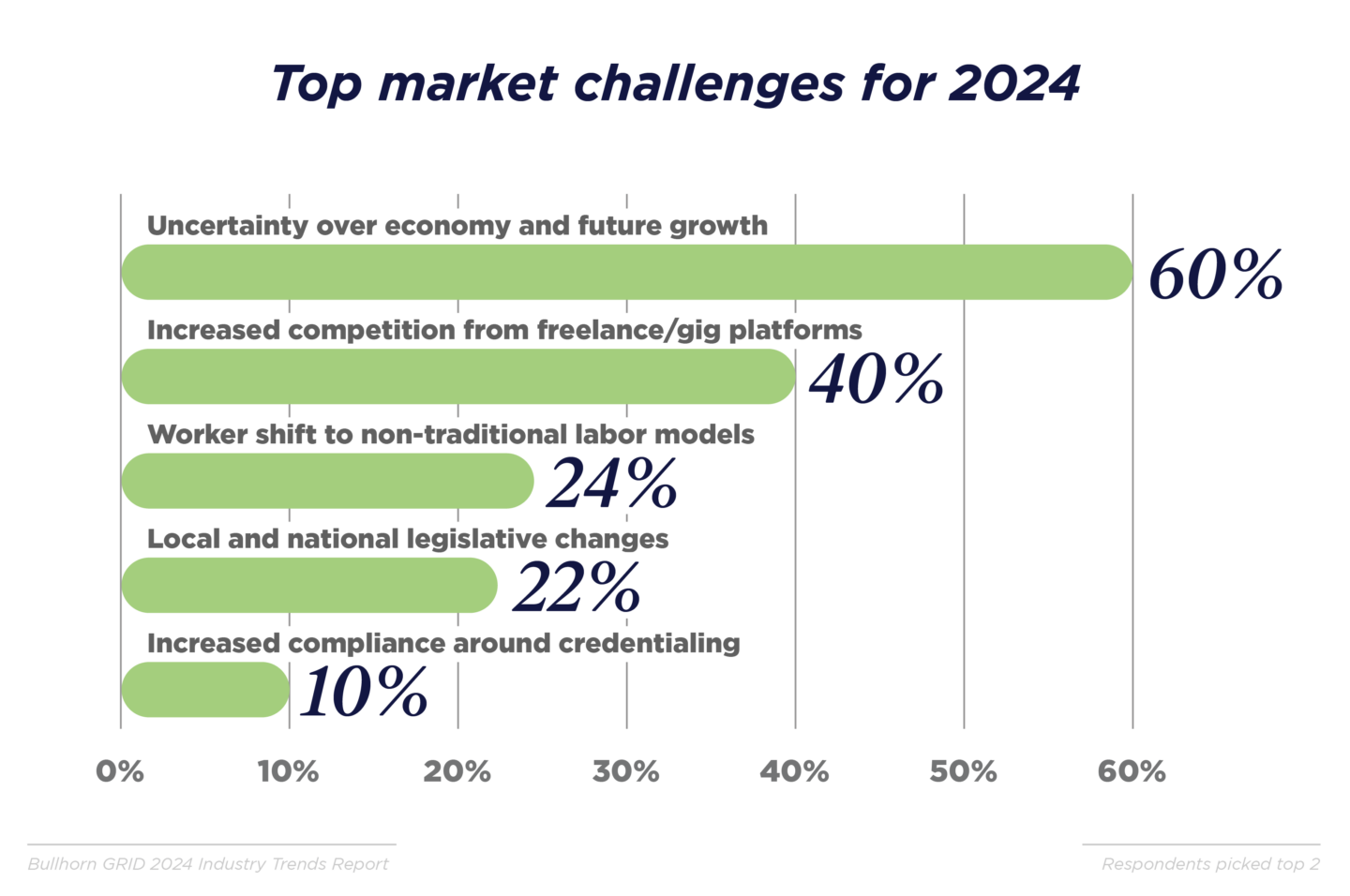

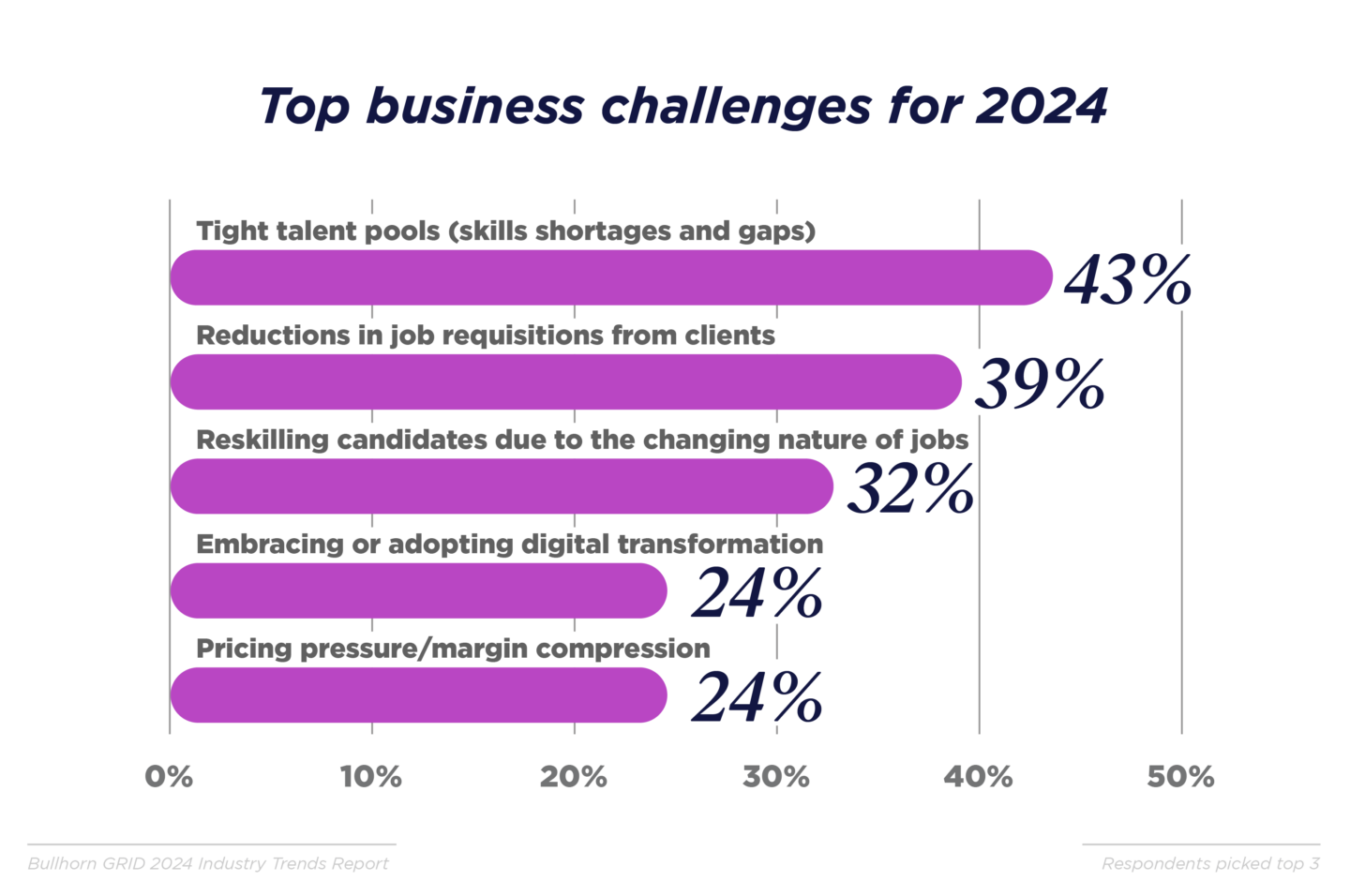

What are firms facing in 2024?

Overall, the economy was the biggest concern for most firms, leading most to prioritize gaining new clients and nurturing existing client relationships. Beyond the focus on retaining and developing new business, firms remained focused on creating a talent experience that will allow them to serve their clients even as the talent shortage continues. In both cases, firms are relying on technology to achieve their critical priorities.

One concern that arose for the first time this year is competition from gig platforms and what this might say about changing employee preferences. Firms are thinking creatively about how to stay ahead of this market shift.

Key insights

What are the top-performing firms doing differently?

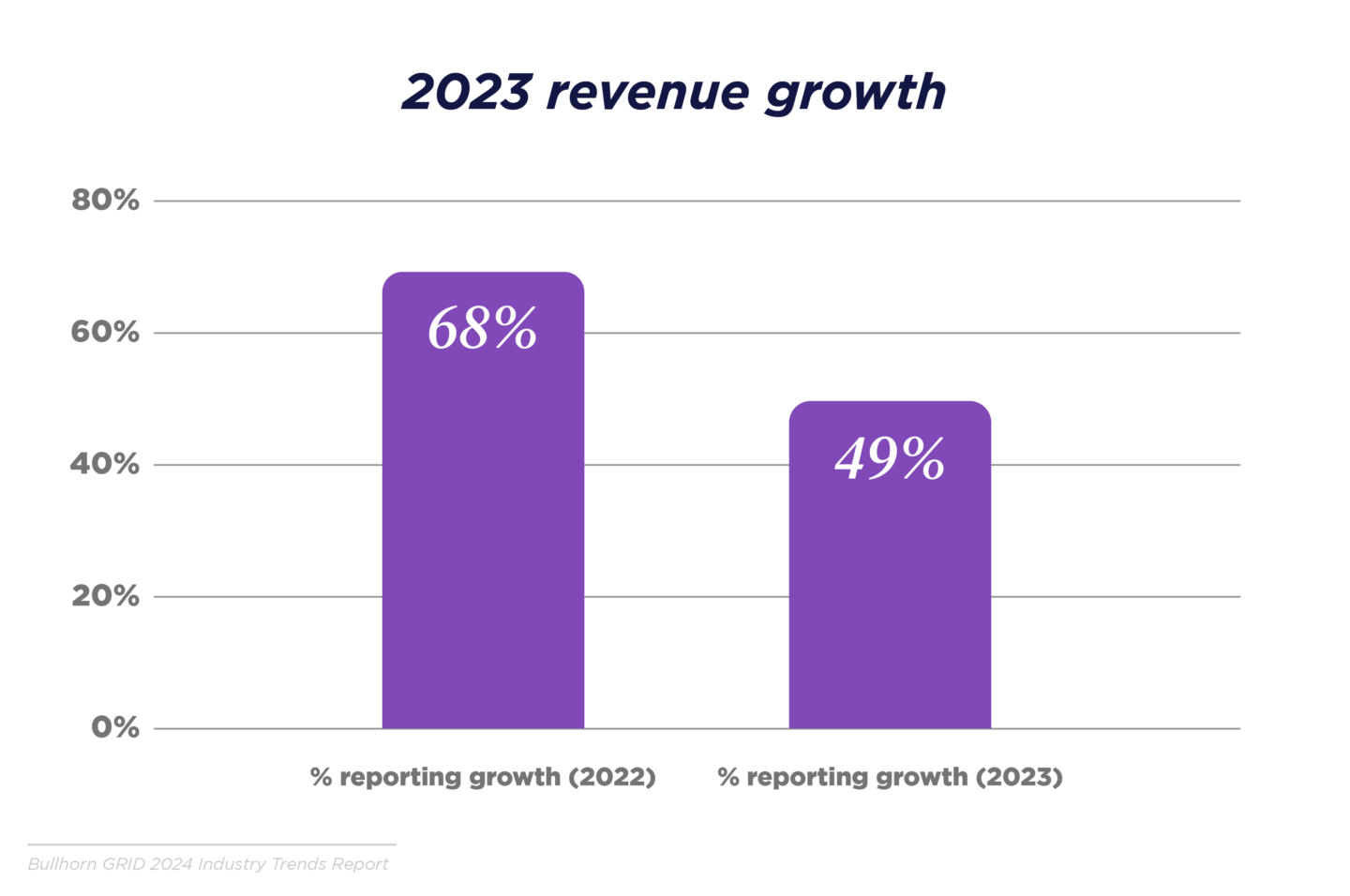

Heading into 2024 in the midst of an economic slowdown and ongoing talent shortage, staffing firms have to be more focused than ever on revenue generation and margin preservation. Looking at the industry’s priorities and the strategies of the top-performing firms (those that saw year-over-year revenue growth of 10% or more), we identified some key insights to help navigate the challenges and opportunities ahead.

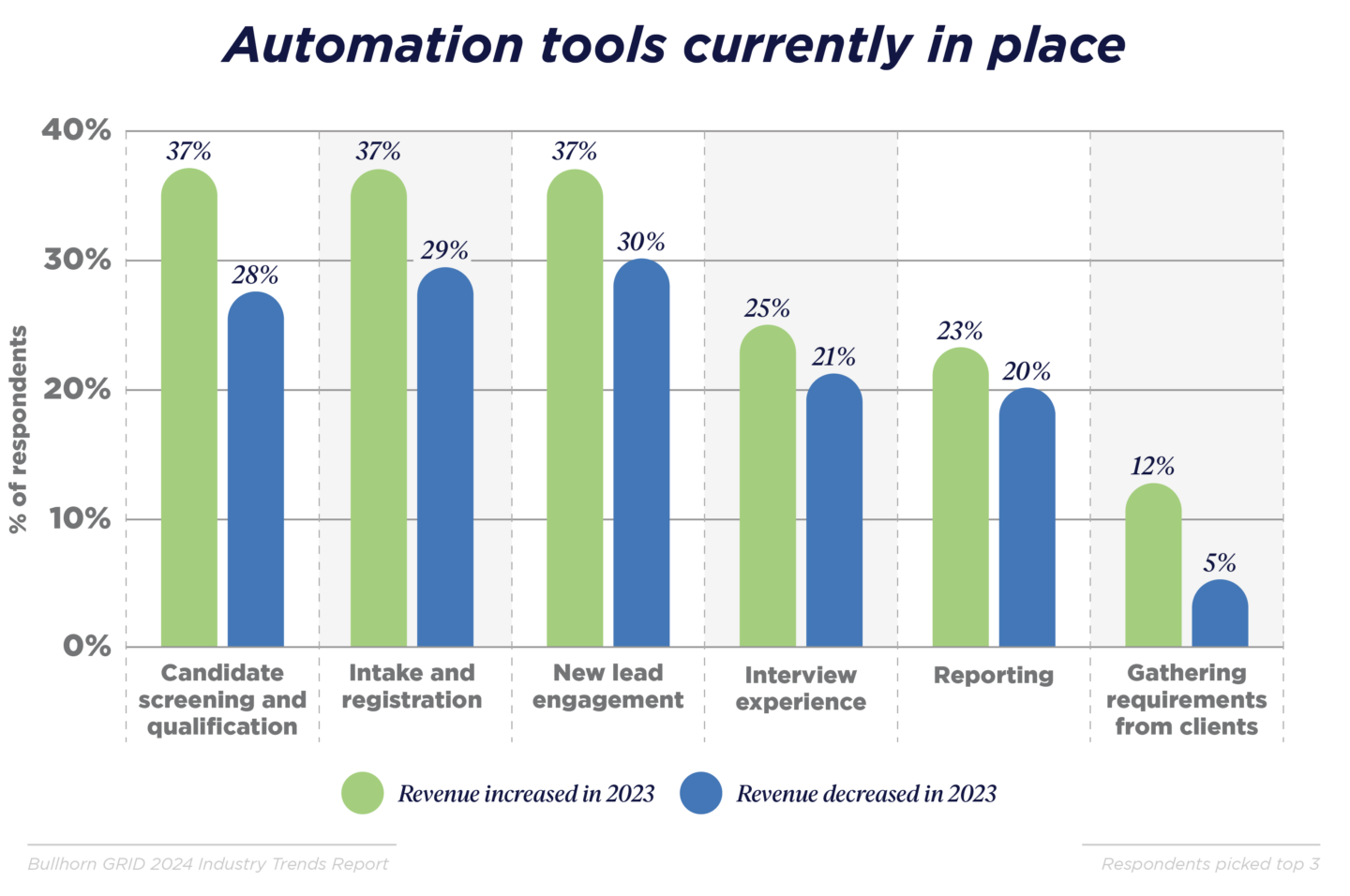

How are high-performers deploying automation?

They are more likely to have automated key tasks. They are 2.4 times as likely to have automated gathering client requirements and 32% more likely to rely on automation to handle candidate screening. And Bullhorn data shows that firms that automate their processes see 39% more submissions per head and fill 22% more jobs.

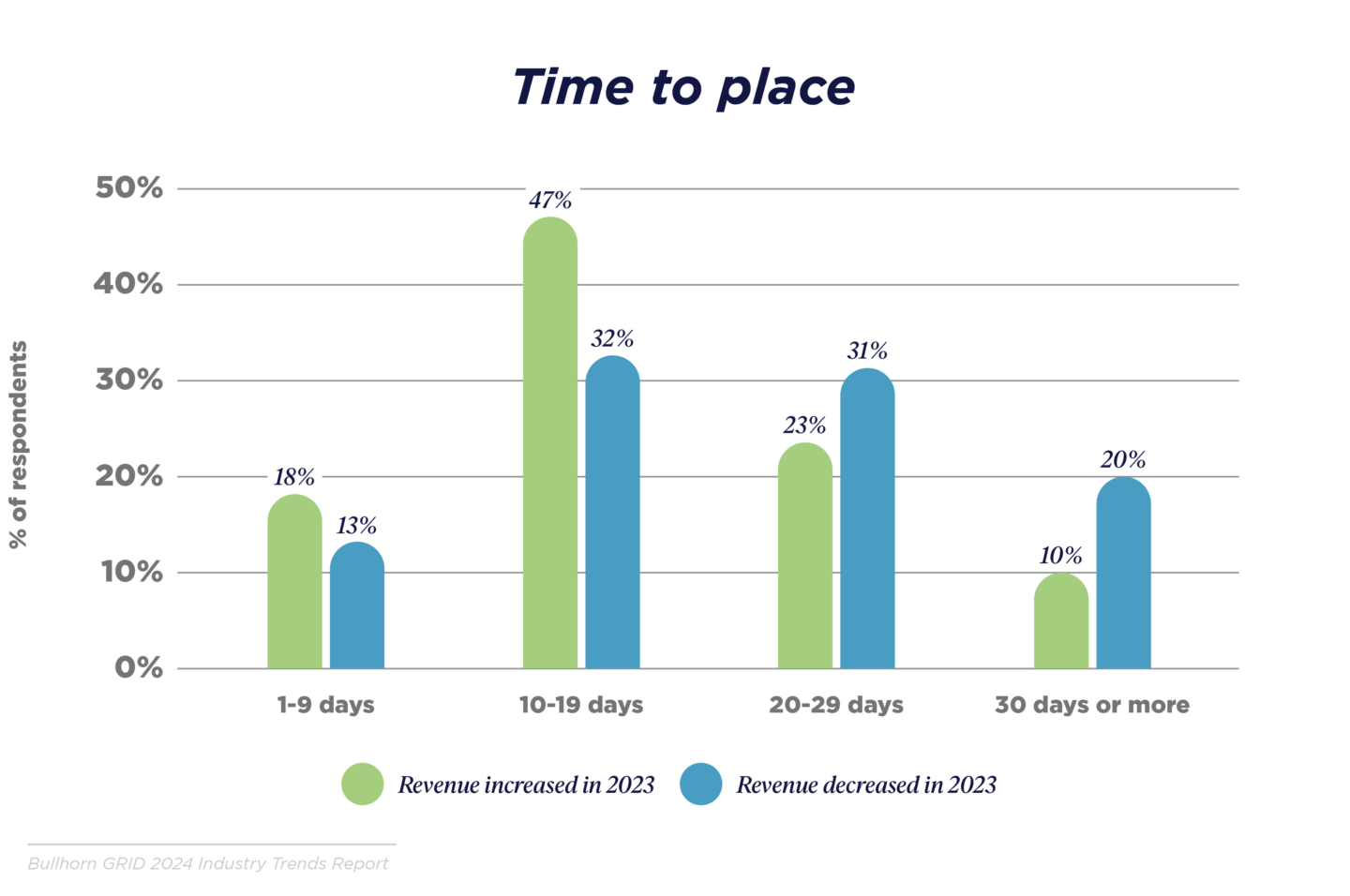

10-19 days is the sweet spot for time to place

Firms that saw revenue growth in 2023 tended to be linked to placing candidates in 10-19 days. 59% of the highest performers placed candidates in 19 days or less. Firms should consider investing in automation tools since Bullhorn data show that firms that automate their processes see a 26% reduction in time to place.

Setting up multiple interviews is a crucial way to impact time to place, and across the Bullhorn customer base, the number of candidates submitted for multiple interviews fell by 14% from 2022 to 2023.

What does this mean for firms in 2024?

For at least the beginning of 2024, clients will still be exhibiting caution when it comes to hiring. That means slower hiring cycles and a focus on truly mission-critical, high-value projects. Staffing firms will want to stay focused on the fundamentals: improving placement times and redeployment rates by leveraging technology to speed up and improve sourcing and candidate engagement.

Firms that continue to invest in their technology and talent pools will be well positioned for 2024, and even better positioned when the economy bounces back.

What does this mean for firms in 2024?

Investing in talent-focused technology and automation will be more important than ever in 2024 — the data above make it clear that top-performing firms are doing just that. What all these investments have in common is using automation to deepen and tailor talent engagement without additional staff or human effort. In particular, by automating outreach, job matching and all the tasks related to onboarding and intake.

In 2024, as the economy continues to be challenging, this kind of differentiation will showcase firms’ expertise and make them stand out with clients.

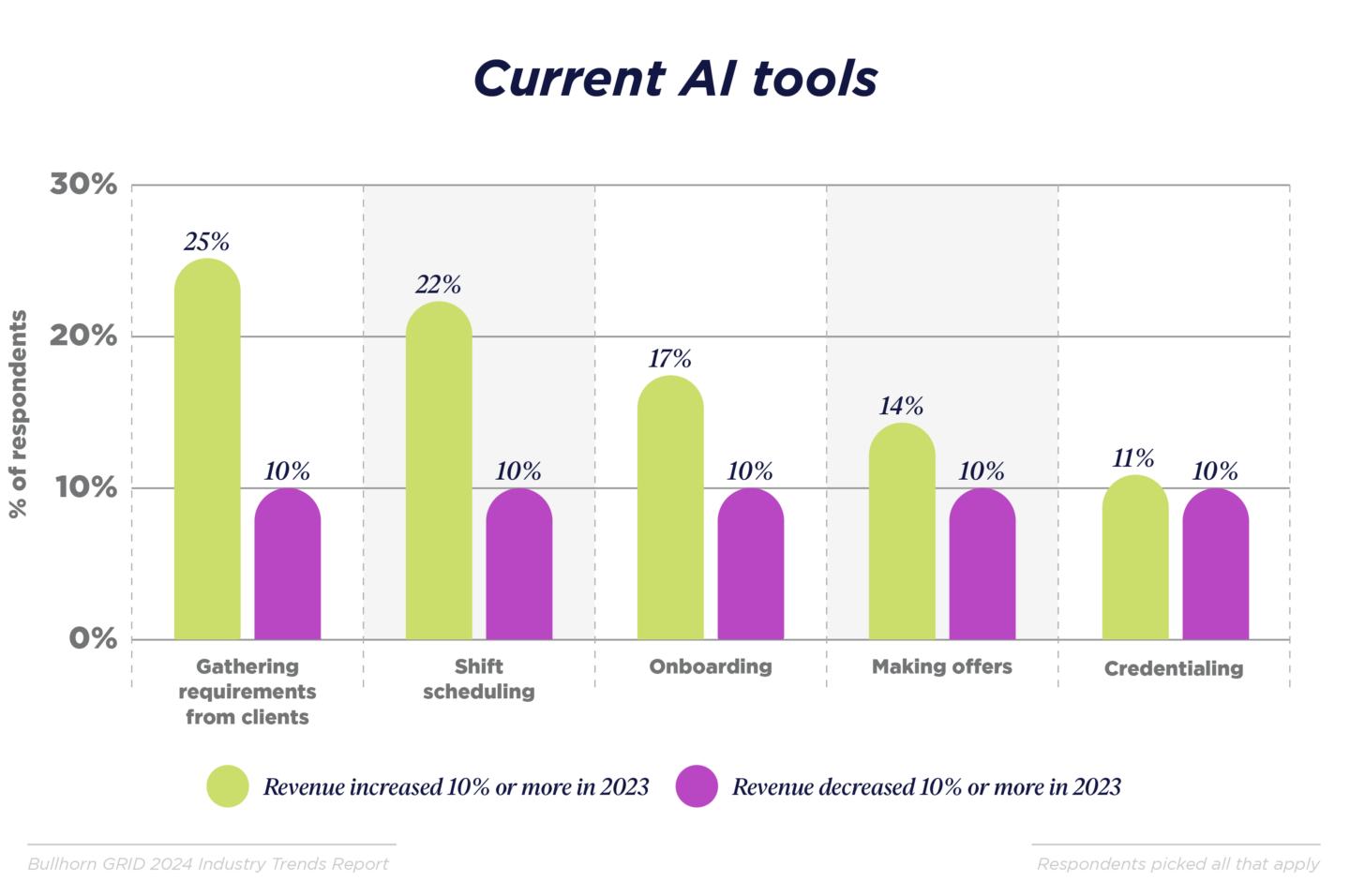

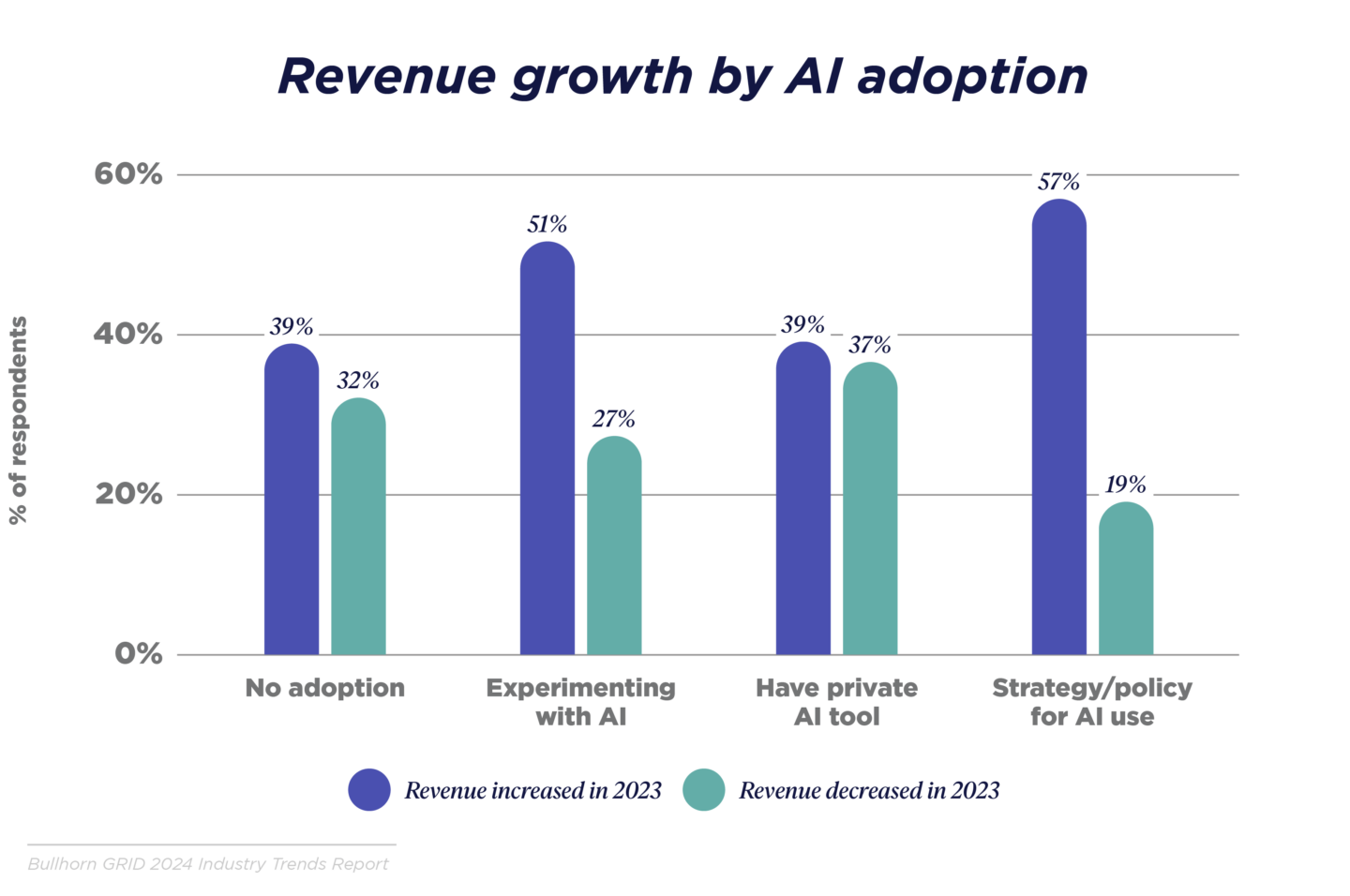

AI adoption correlates with revenue growth

Firms with an AI strategy were the most likely to report revenue growth in 2023 (57%), followed by those who are experimenting with generative AI (51%). Most likely, this is an indication of the firms’ overall willingness to adopt technology rather than direct revenue generation from AI. But, in speaking with staffing firms, most predict that AI will be a regular part of every business by 2025.

What does this mean for firms in 2024?

Winners in this market are investing heavily in automating and applying AI to rote tasks that can easily be handled completely or in part by technology, like onboarding paperwork and gathering job requirements. That way, human beings can step in only when there is an exception or to perform a final review, freeing them up to focus on strengthening client relationships, pursuing new business opportunities, and offering higher-margin services like consulting. Lower-performing firms are missing opportunities to automate repetitive tasks, to leverage AI to improve their talent and client engagement, and aren’t automating new lead engagement to the same degree.

Firms who get out in front on this trend and are early adopters of new technologies will enjoy a significant competitive advantage moving forward and remain winners.

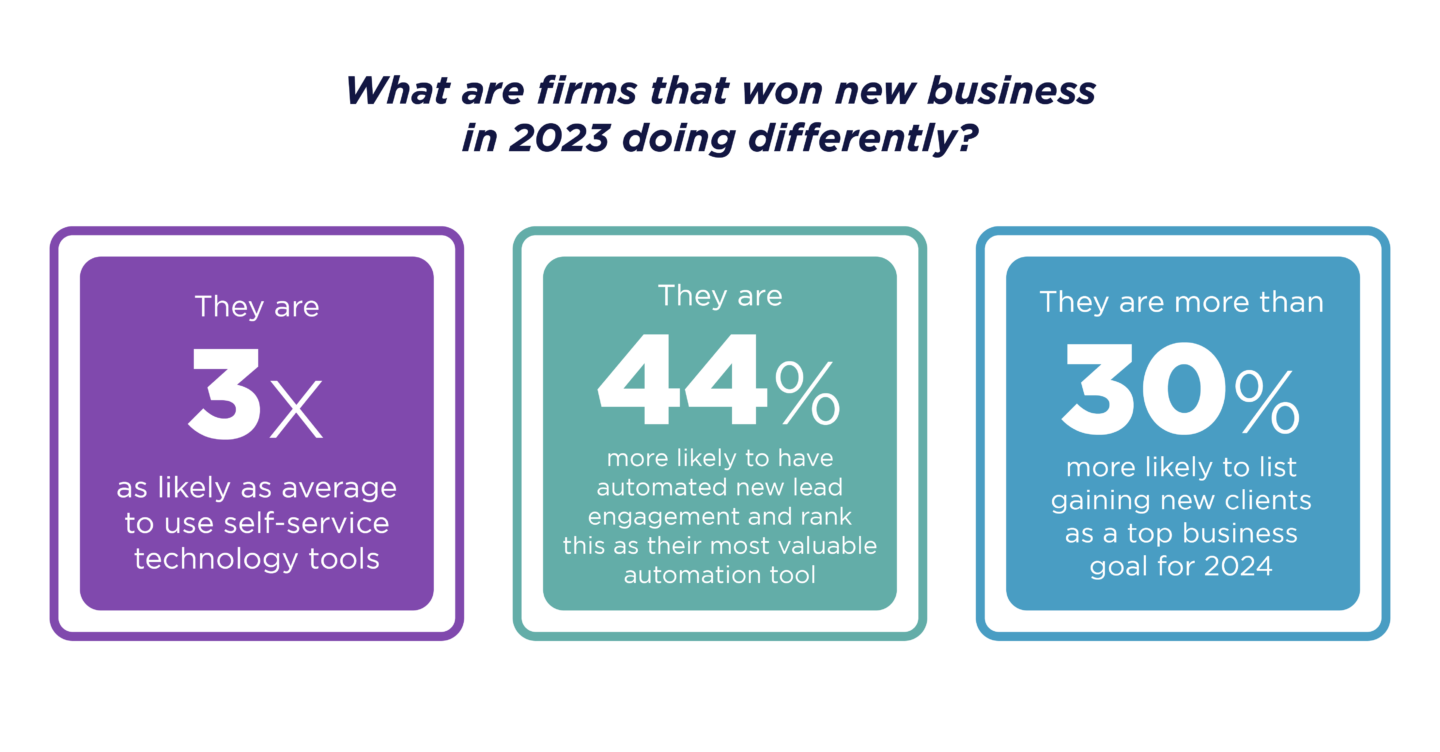

What does this mean for firms in 2024?

With the economy still uncertain, firms will need to closely examine what wins them business — and what is losing it. The data clearly indicate that digital transformation and implementation of sales-support technology drive sales wins. The tough economy in 2023 really separated the wheat from the chaff and the data make it clear that high-performing firms are using technology to give themselves a competitive advantage.

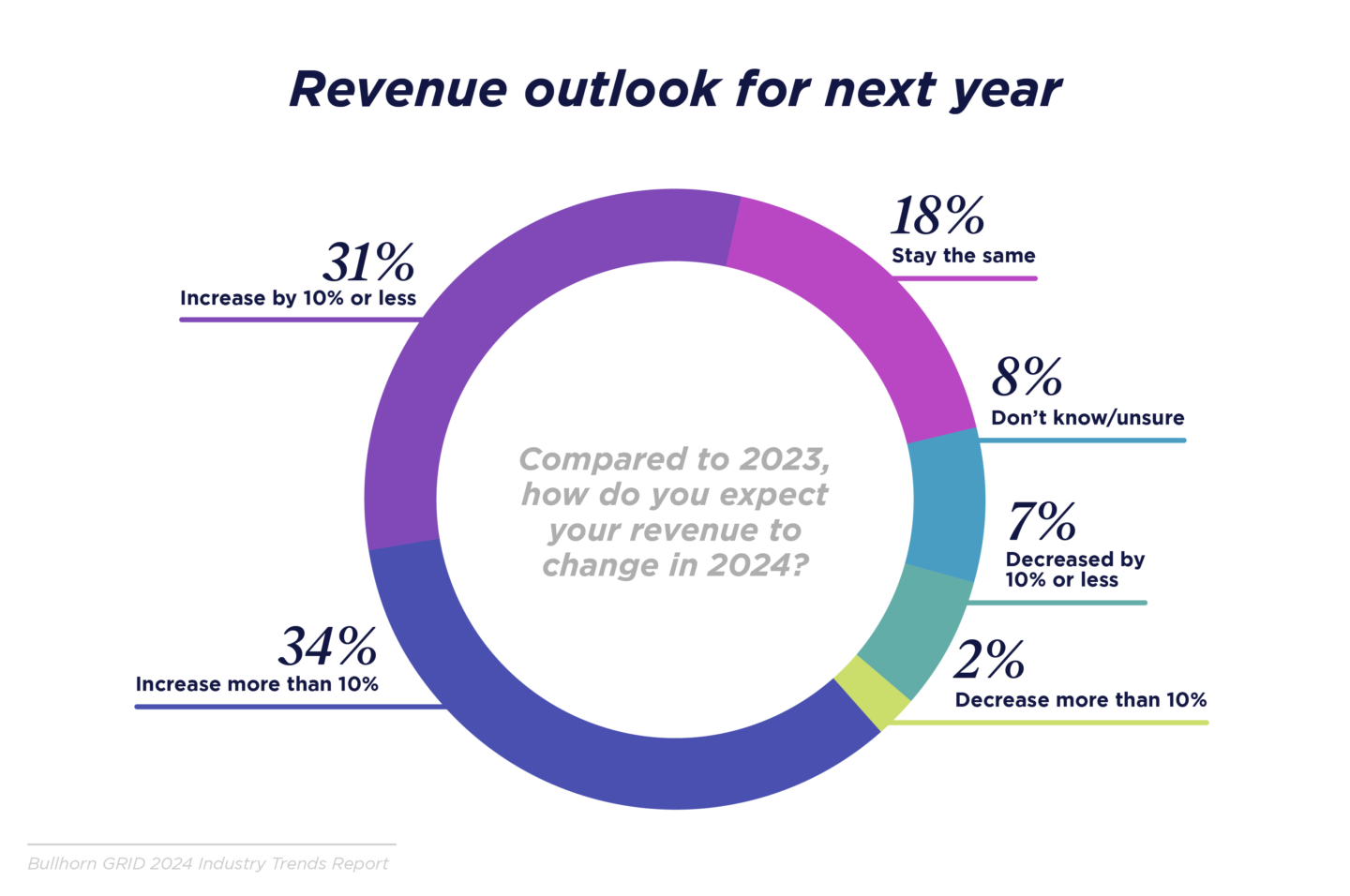

Economic recovery anticipated

Most firms are bullish on 2024, with nearly two-thirds predicting a revenue increase, aligning with hopes that the global economy has a soft landing and actually improves in the latter half of 2024. The positive revenue outlook was consistent across most industries and agency types. However, over 70% of IT and engineering firms expect revenue growth in 2024, whereas only 57% of light industrial firms say the same. DACH and the UK and Ireland are particularly optimistic in predicting an economic recovery that benefits the staffing industry.