What does this mean for agencies in 2023?

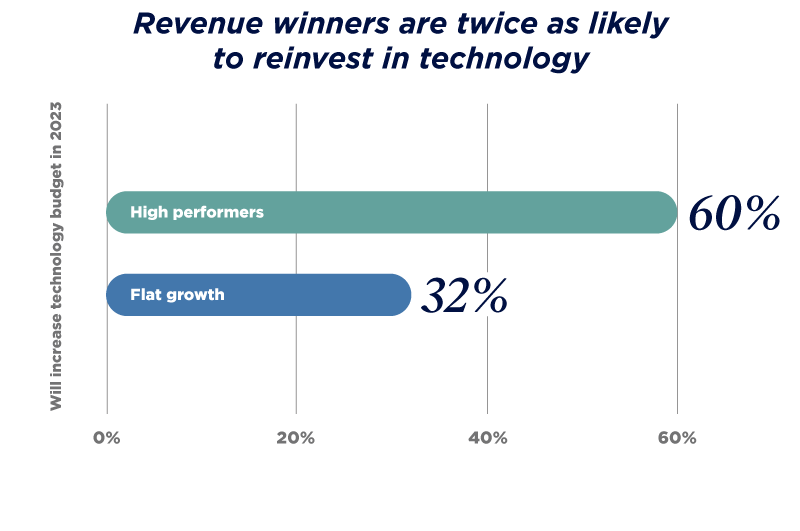

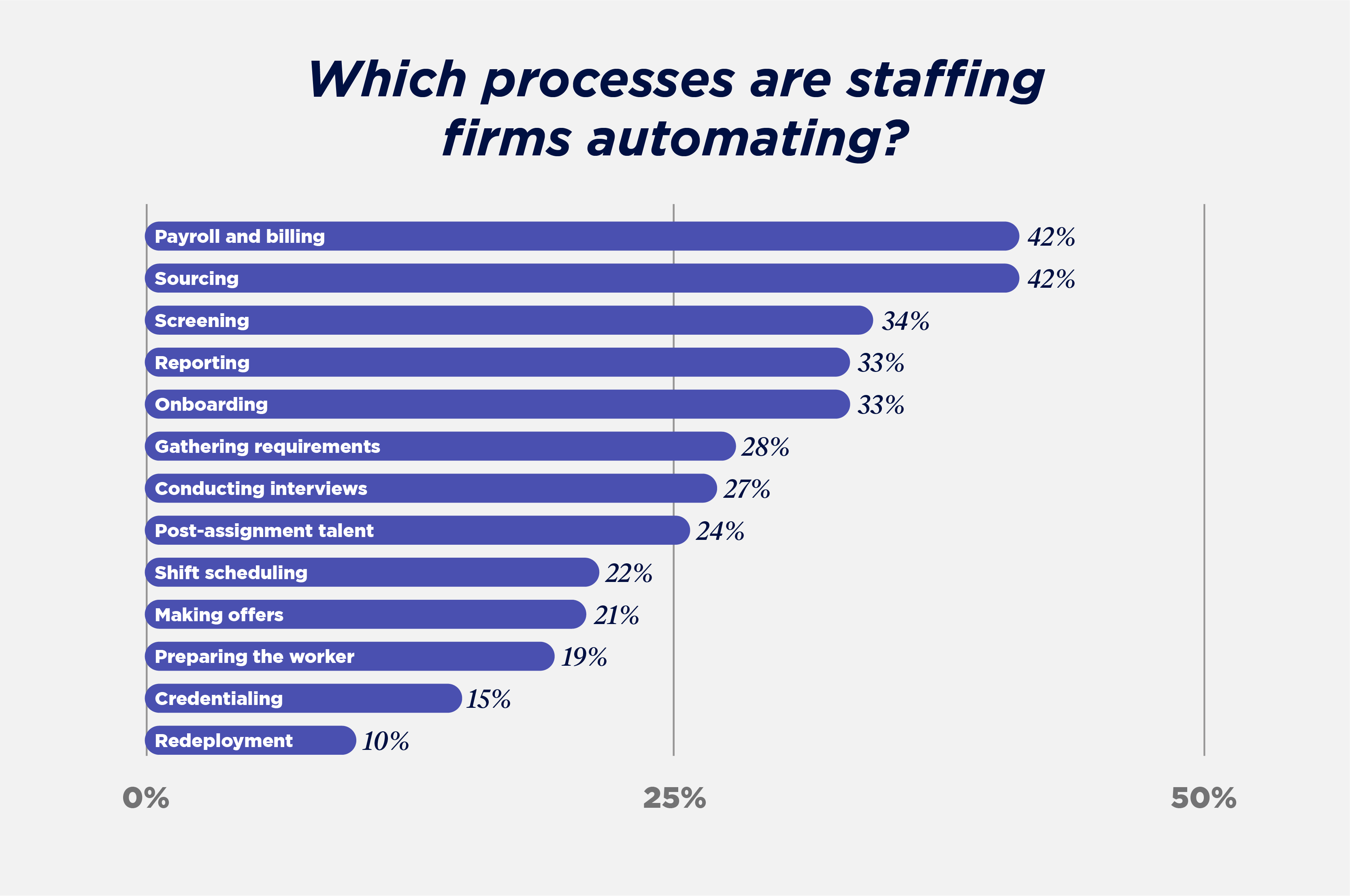

It’s clear that agencies are leveraging technology to fuel their success, but the industry is just beginning to realize the benefits of digitally transforming their business. For example, less than one-fifth of respondents leverage automation throughout their business.

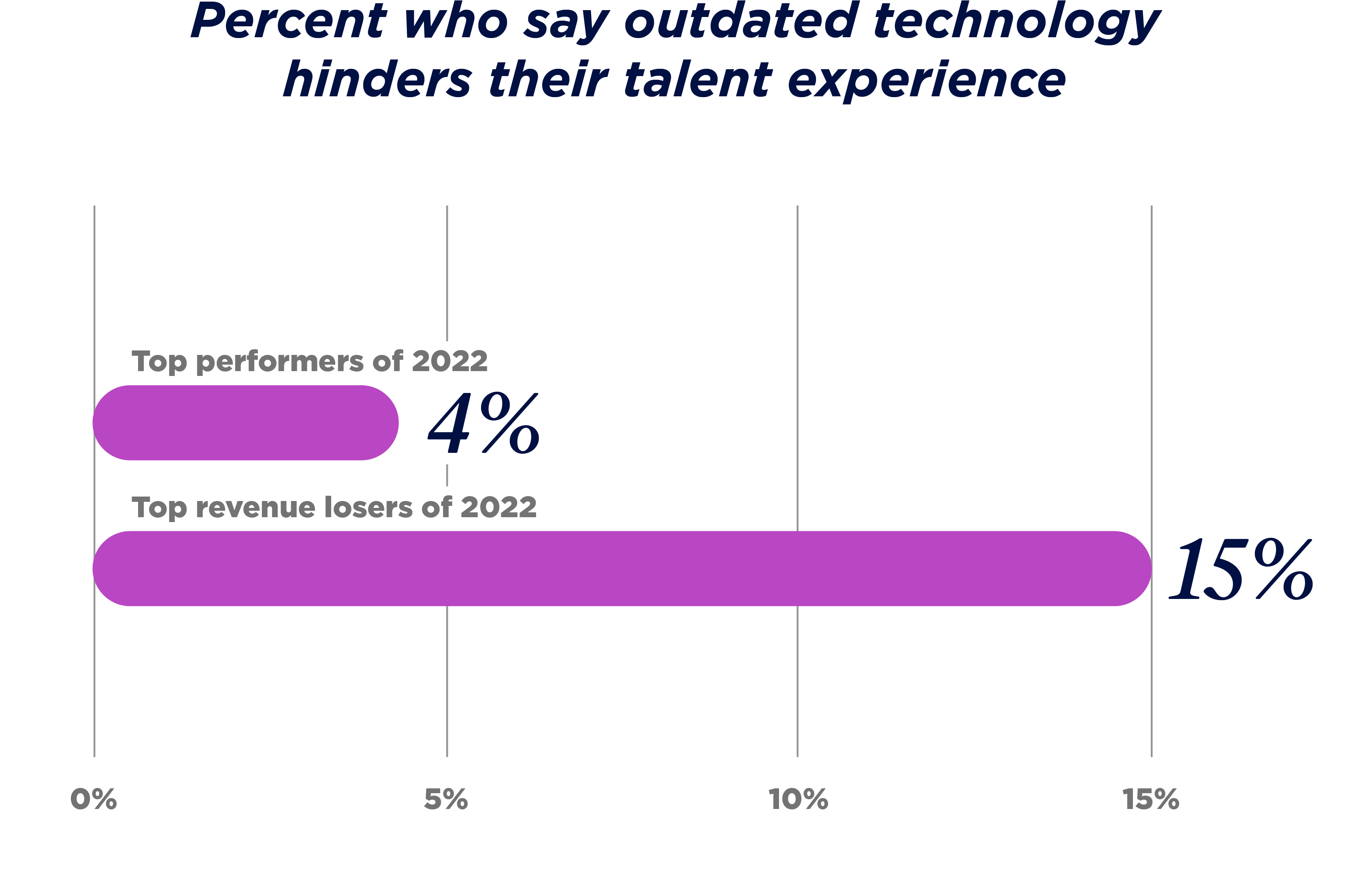

Firms that continue to invest in their technology and talent pools will be well-positioned for 2023 and beyond.

What does this mean for agencies in 2023?

Given that the top performers are already twice as likely to leverage automation throughout their business and they’re the group most likely to ramp up efforts in 2023, firms that don’t keep up risk falling behind.

Those who do step up their efforts may enjoy a significant competitive advantage moving forward.

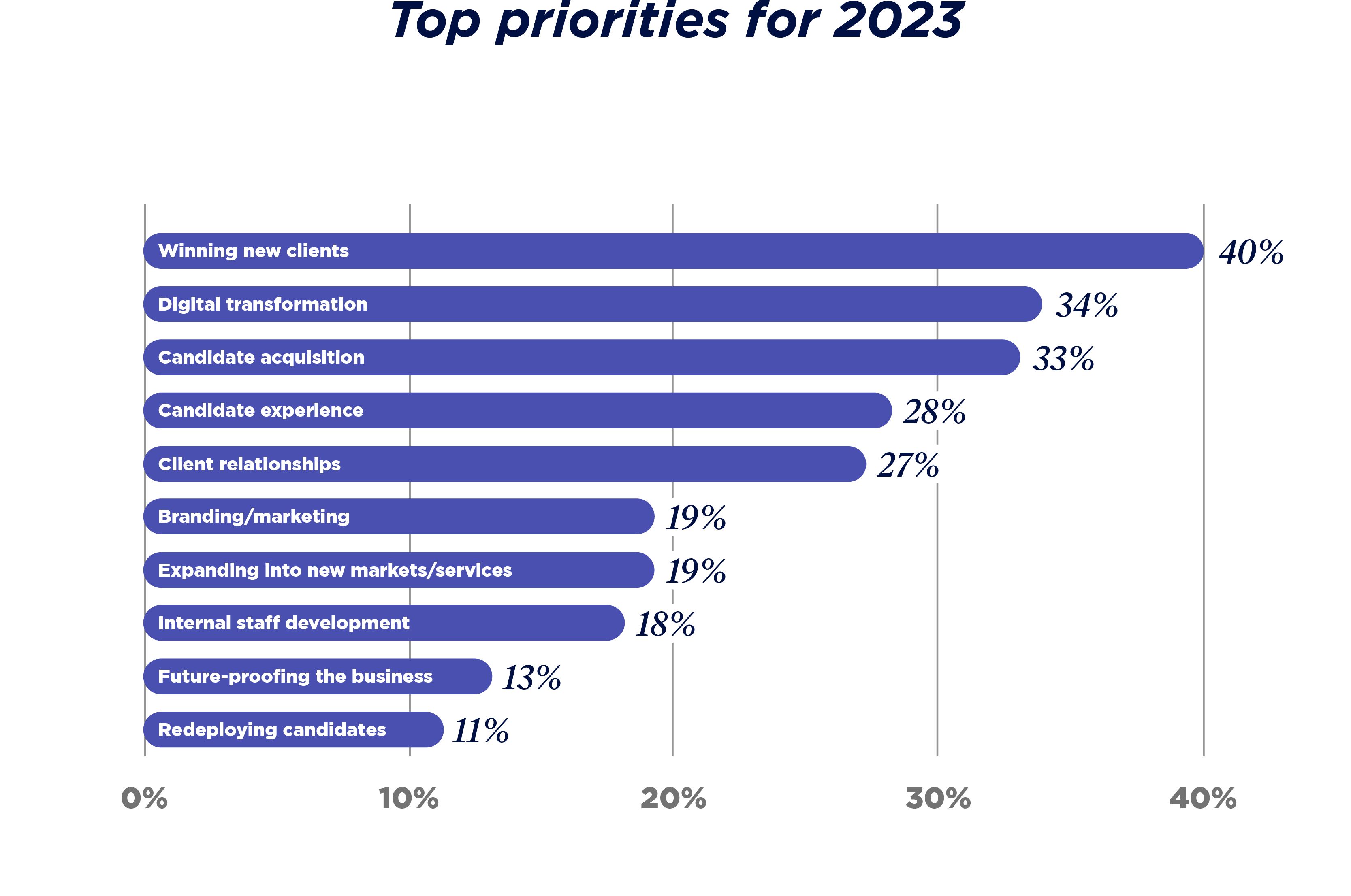

Last year, client development wasn’t the top priority for recruitment agencies, and it’s hard to understate how unusual that was. For the first time in the survey’s 13-year span, winning new clients wasn’t a top-three priority. While candidate acquisition had been the top priority for six consecutive years, last year, increased skills shortages and unprecedented demand led to a decisive talent-first approach. This year, winning new business makes its return to the top.

Why is this year different?

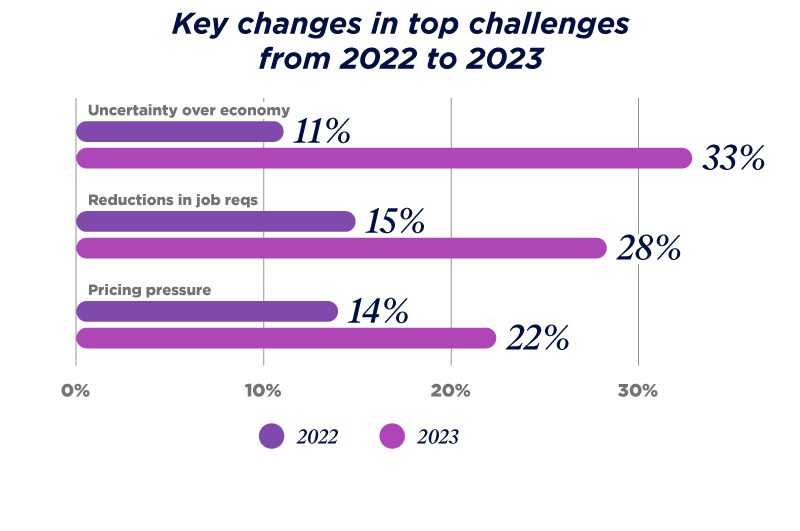

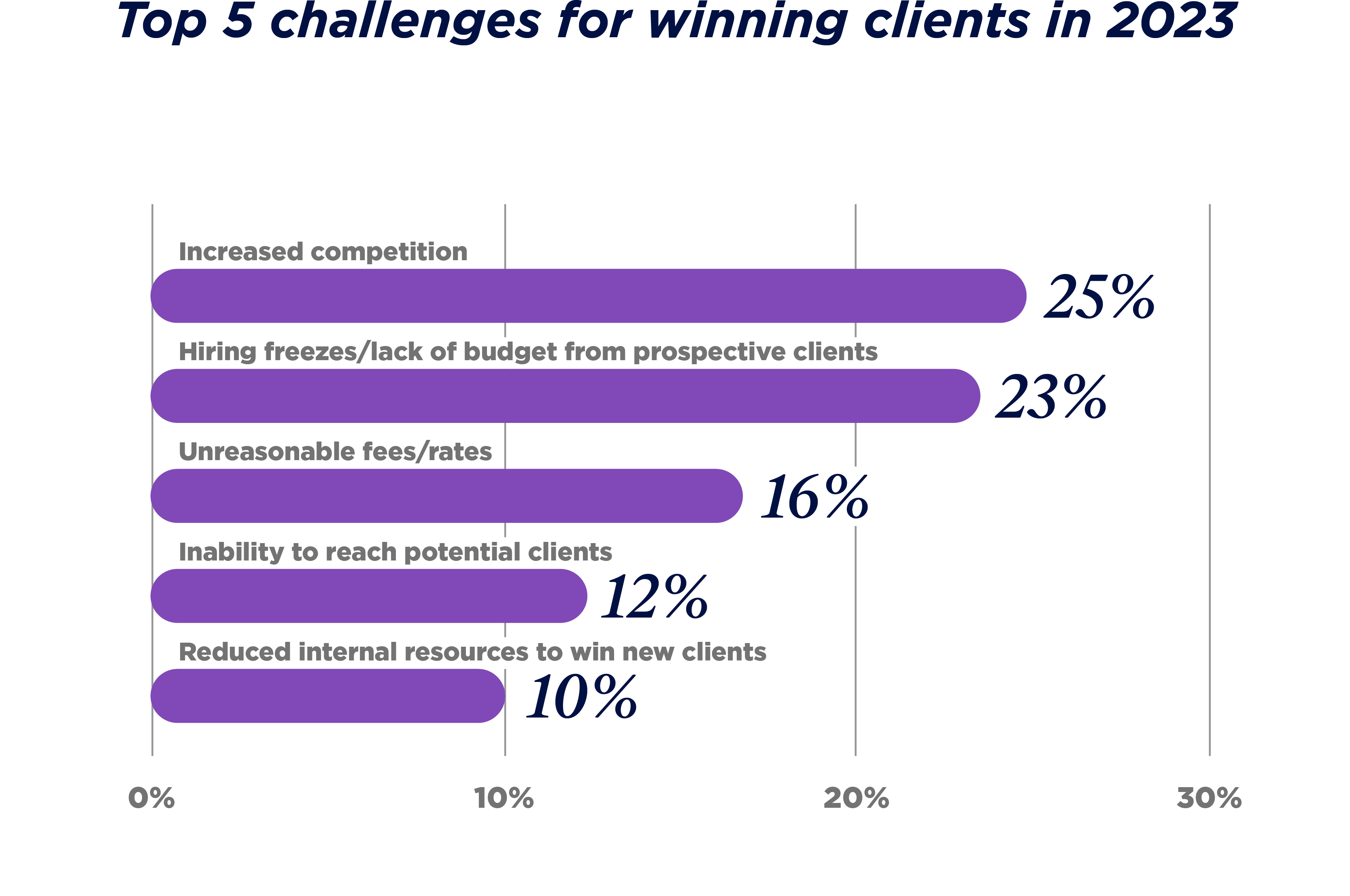

In short, changes to the recruitment landscape have led firms to reprioritize winning new clients. In particular, pricing pressure, reductions in job requisitions, and economic uncertainty are major considerations new to the year ahead.

Three times as many agencies cite economic uncertainty as a challenge in 2023 compared to 2022. Meanwhile, pricing pressure and job requisition reductions are top challenges after barely registering in the top 10 last year.

What does this mean for agencies in 2023?

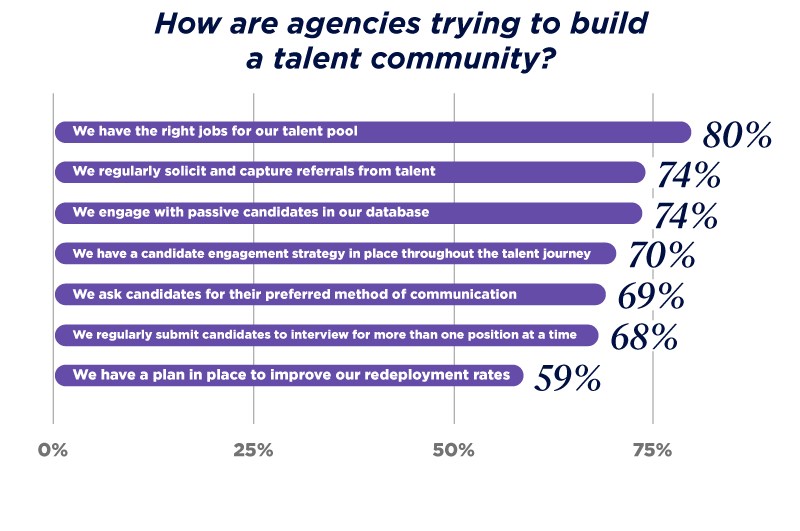

While the majority of agencies report employing talent engagement best practices, the firms who lag in this area are paying the price with talent. In every instance in the chart above, firms that followed the best practice were 30% or more likely to report revenue gains in 2022.

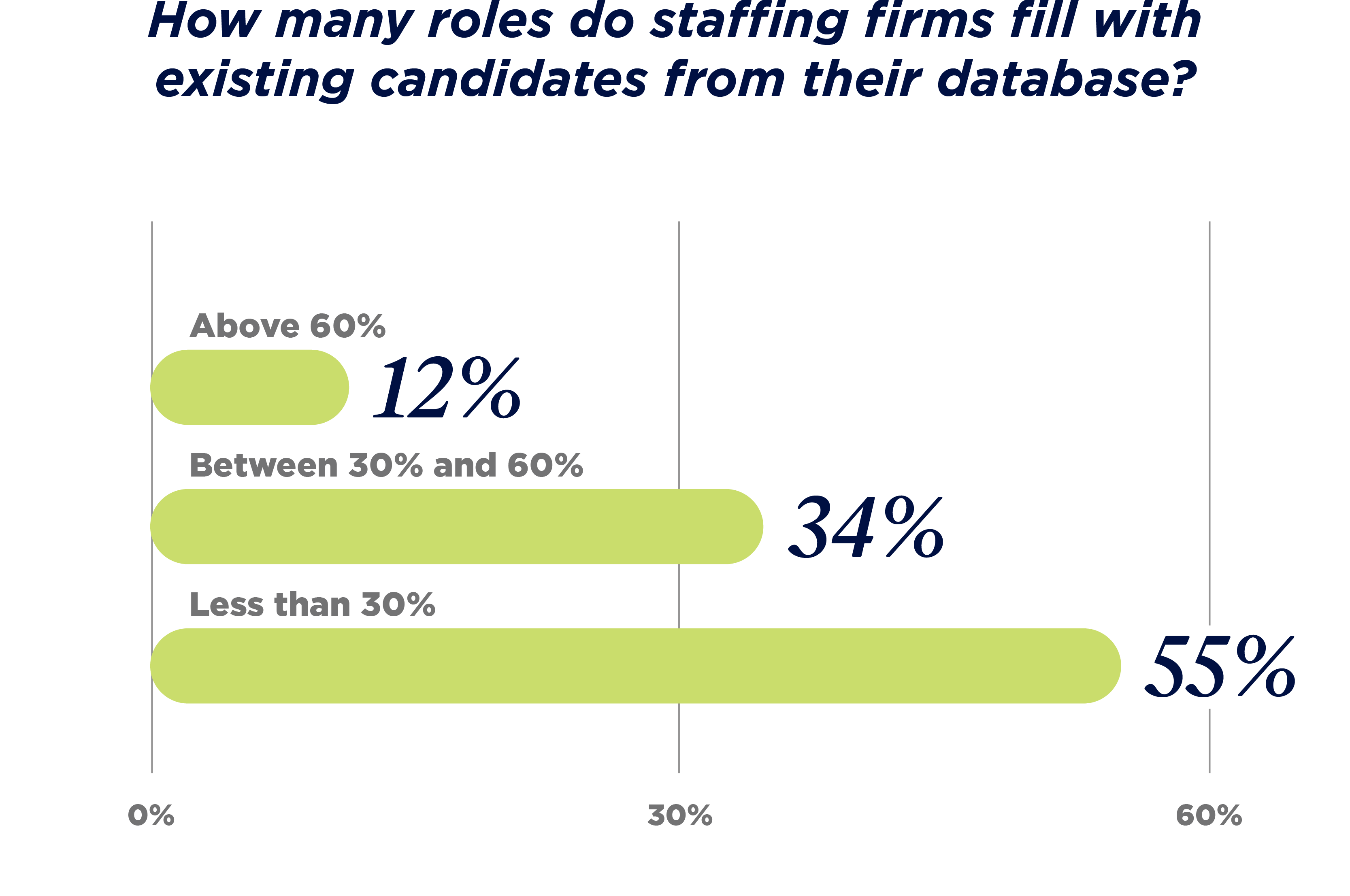

The two biggest talent pool factors correlated with success last year? Redeployment and candidate database utilization. Firms that outperformed their peers when it came to lining up talent for new roles before the end of the assignment and firms that utilized their existing database to fill a position were twice as likely to report revenue gains last year and 50% more likely to expect gains in 2023.

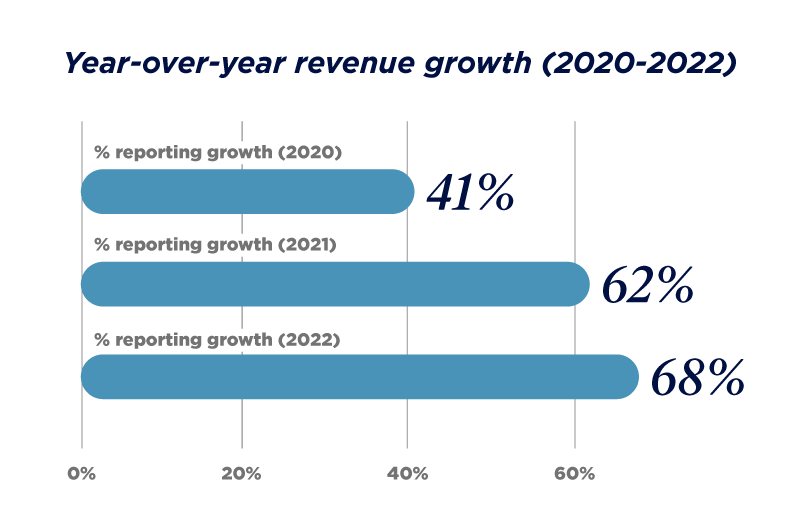

Revenue performance and outlook

Steady gains across the industry in 2022

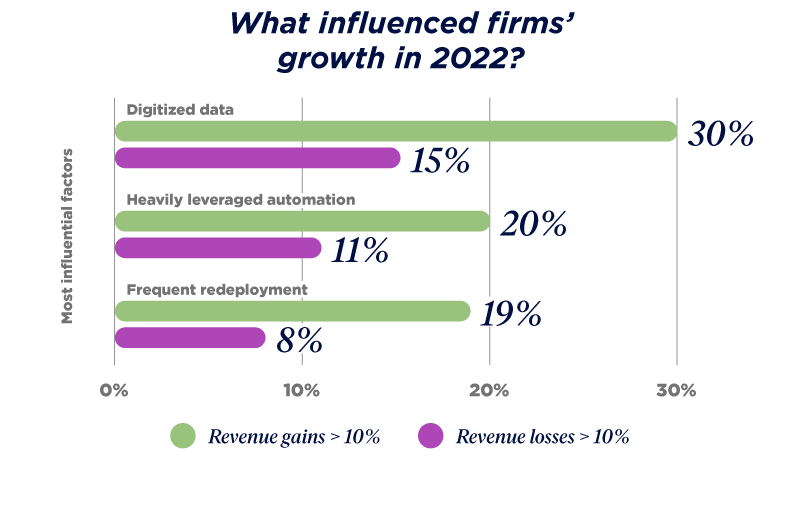

2022 represented another strong year for agencies of all types and an improvement over an already impressive 2021. As we noted in our key insights, technology adoption played a bigger part in success than company type, size, or region.

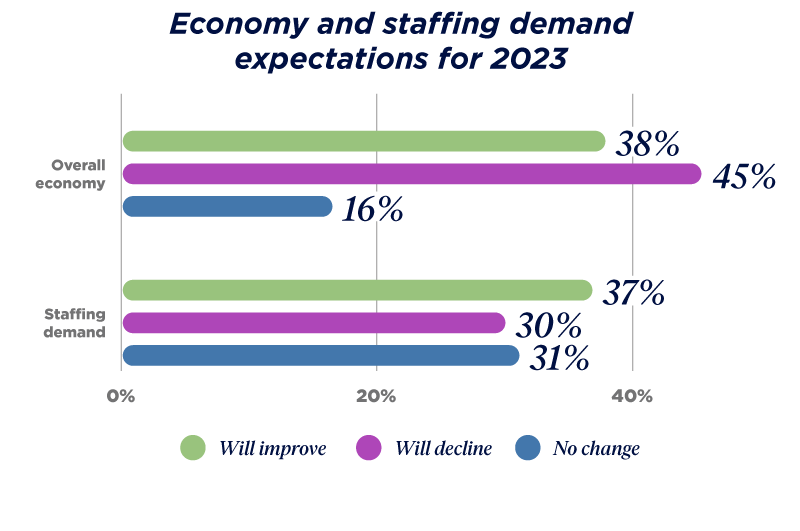

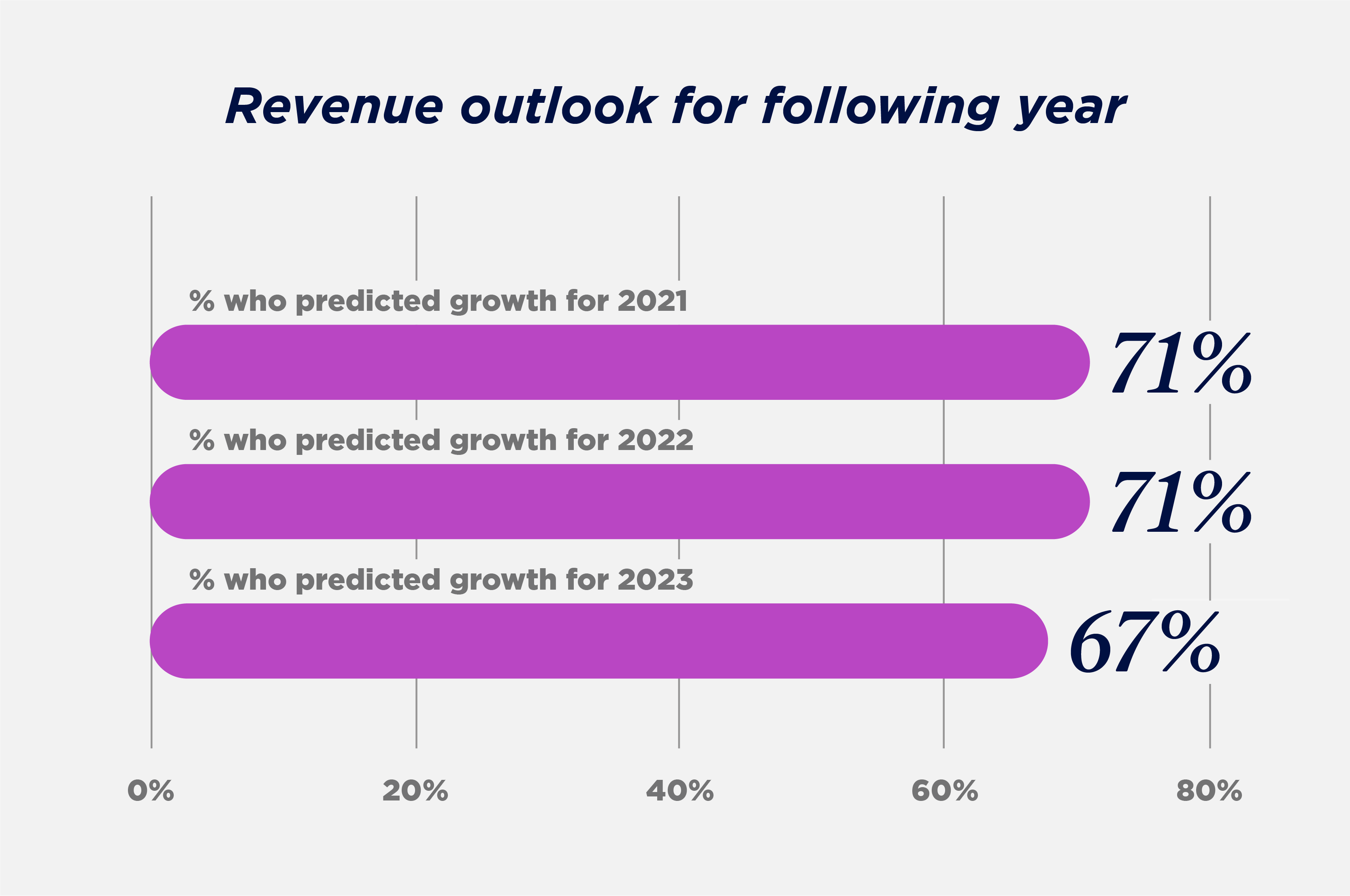

2023 outlook: Cautious optimism

Heading into 2023, the majority of agencies again predict growth in the year ahead, although the predictions are slightly more modest than the preceding two years.

The most likely cause for modest growth expectations in 2023 despite an incredibly strong 2022? Concerns over the economy, increased competition, and pricing pressure.

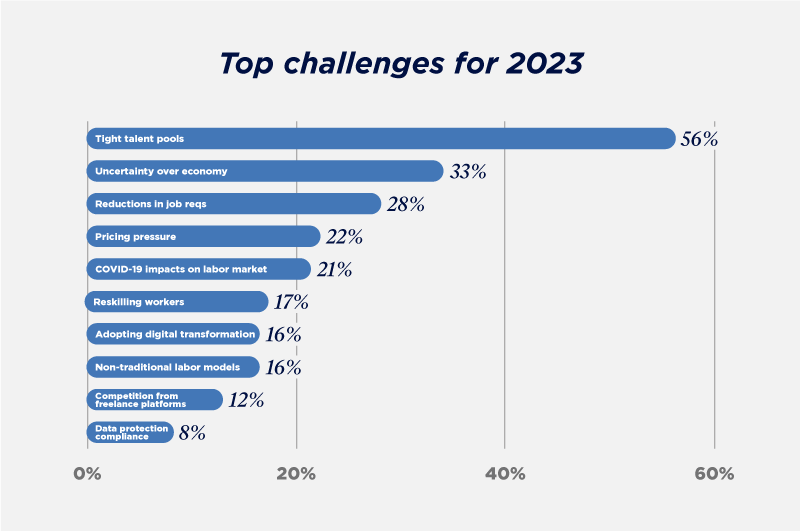

Top challenges

Economic concerns enter the picture

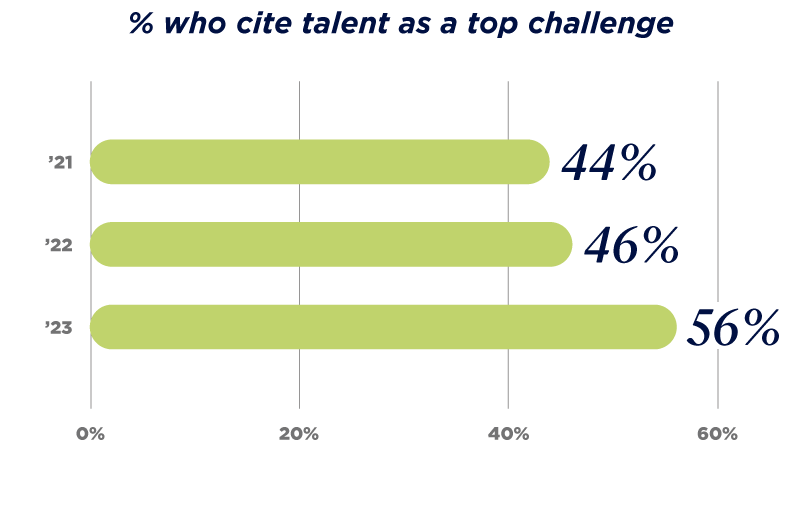

Without exception, agencies of all types and specialties overwhelmingly cited the talent shortage as their top challenge for 2023. Otherwise, challenges look markedly different in 2023. Economic uncertainty and pricing pressure are new to the top five after barely registering in the top 10 last year.

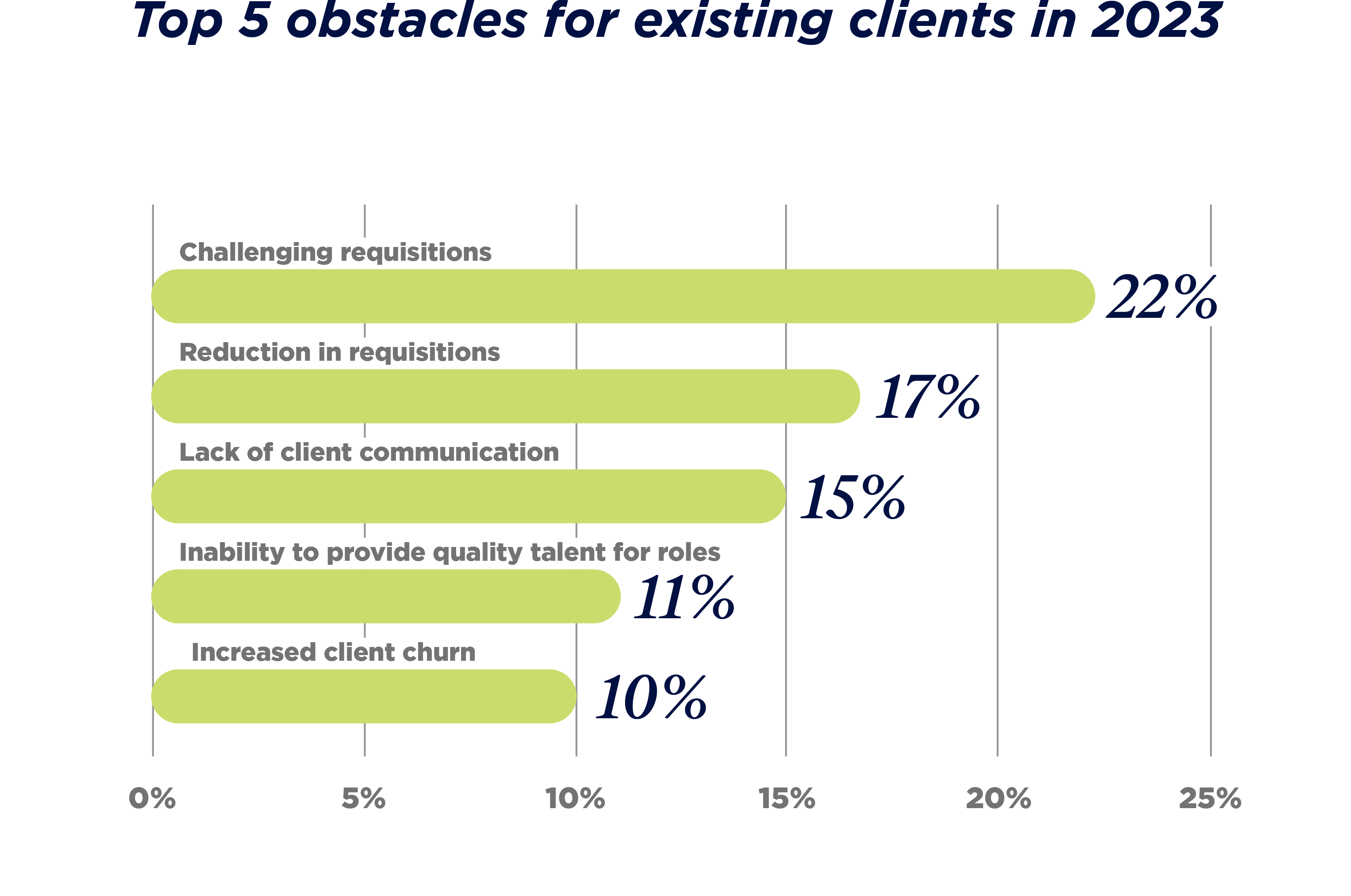

Top existing client challenges: All about the talent

Challenging job requisitions are the top hurdle to maintaining clients in 2023. Relatedly, the inability to provide talent for those roles also landed in the top five. Those who can build and leverage a talent pool of qualified candidates have the best chance to keep clients happy — and away from their competition.

Digital transformation

Most are on board, but few have arrived

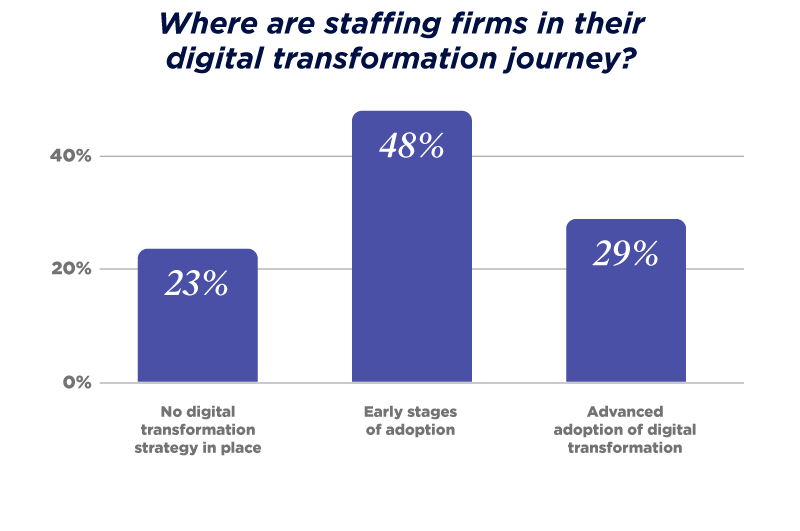

As we discussed above, the industry continues to embrace digital transformation, with a record number of firms citing it as a top priority for 2023. But despite the various benefits, adoption lags. Automation, in particular, represents a major opportunity for most recruitment businesses.

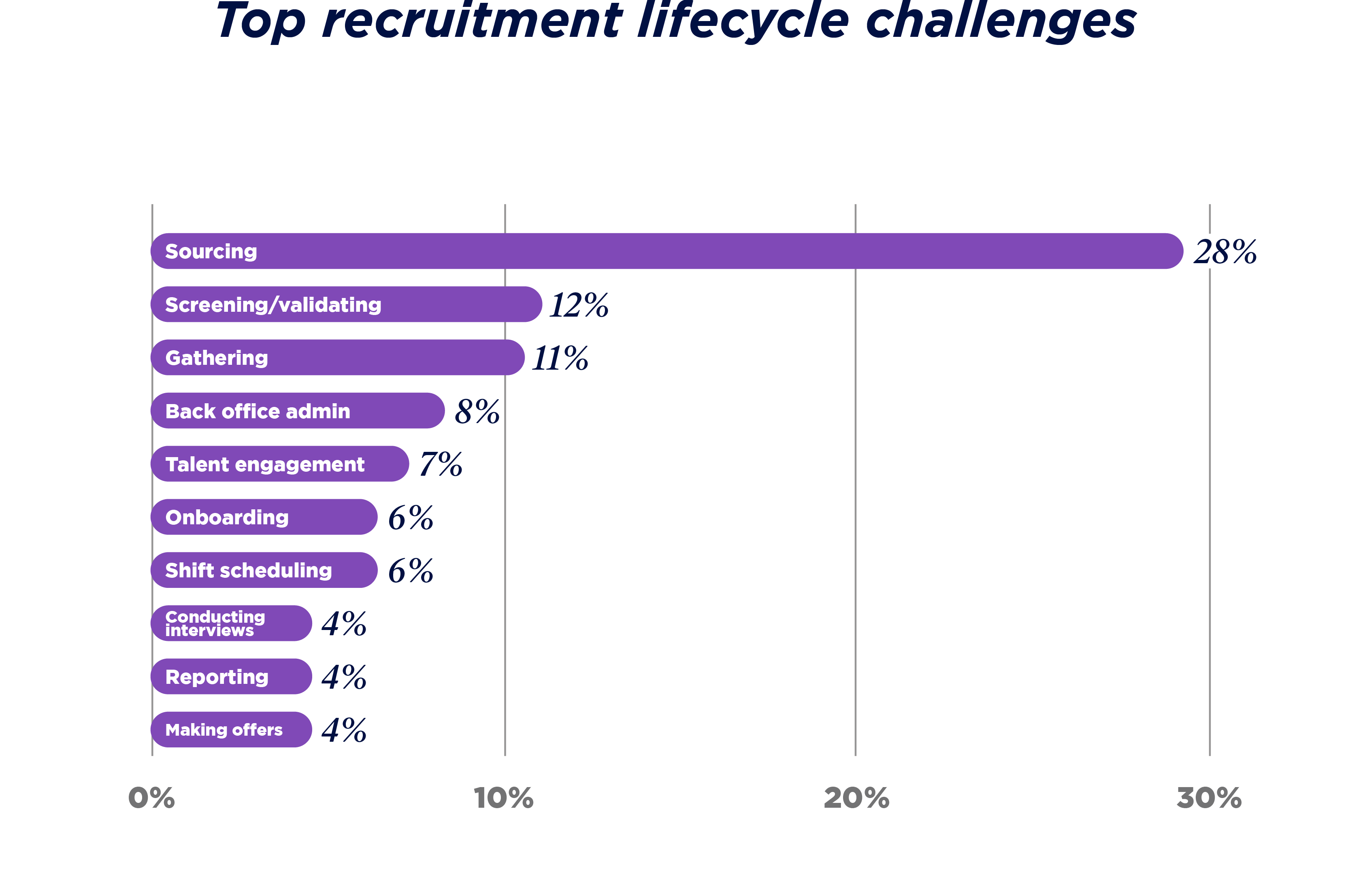

Why aren’t firms leveraging more of their talent pool to fill roles? Fierce competition and limited resources to dedicate to talent nurturing likely play a part, but one major factor: disorganized candidate databases. Two out of five firms (44%) say they can’t rely on their candidate database.

Those who are leveraging their talent pool, however, are reporting significant benefits. As noted in the key insights, above-average database utilization was the single strongest factor correlating with a firm’s likelihood of reporting major growth — 70% of these firms reported major YoY gains in 2022.