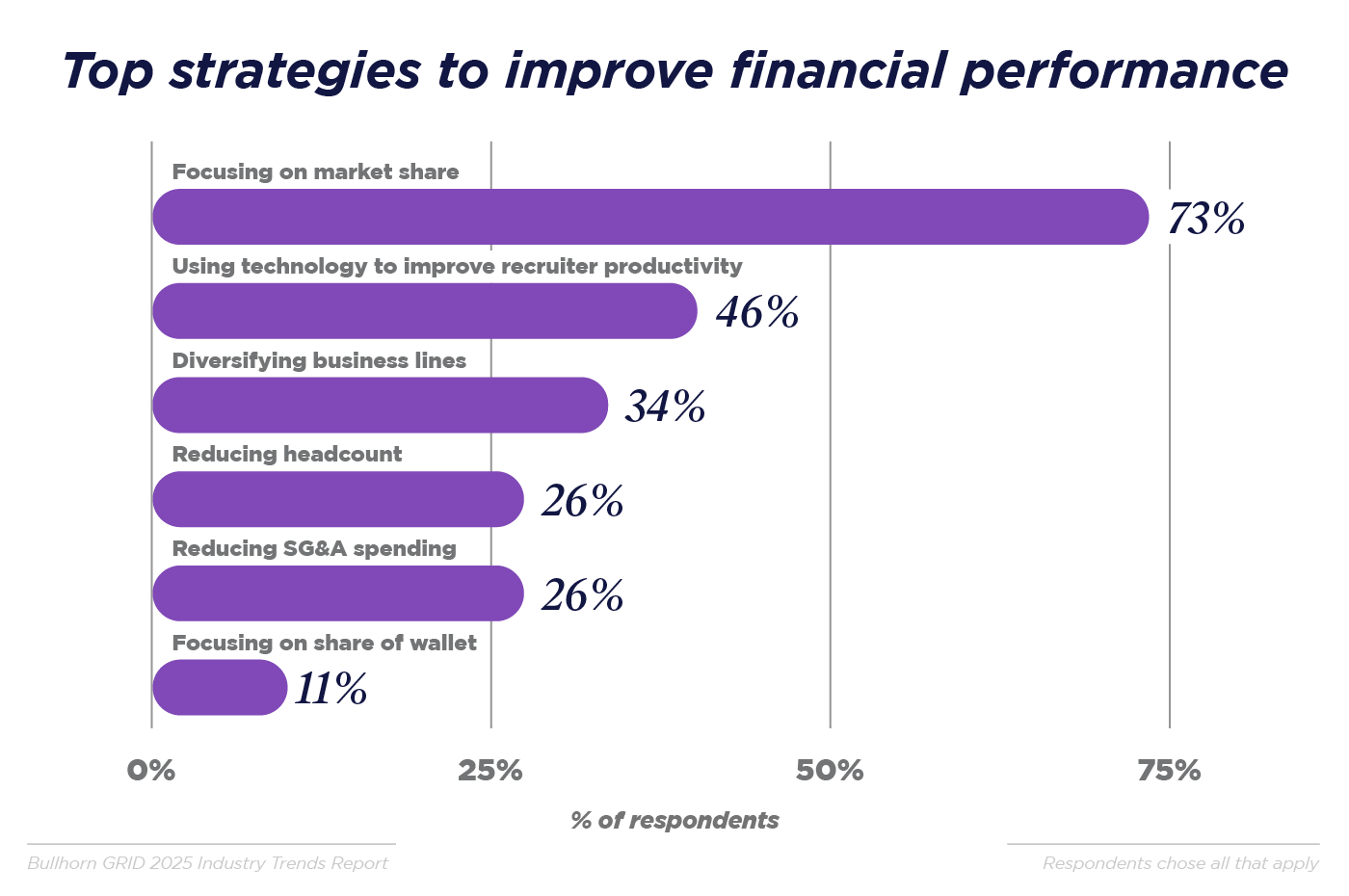

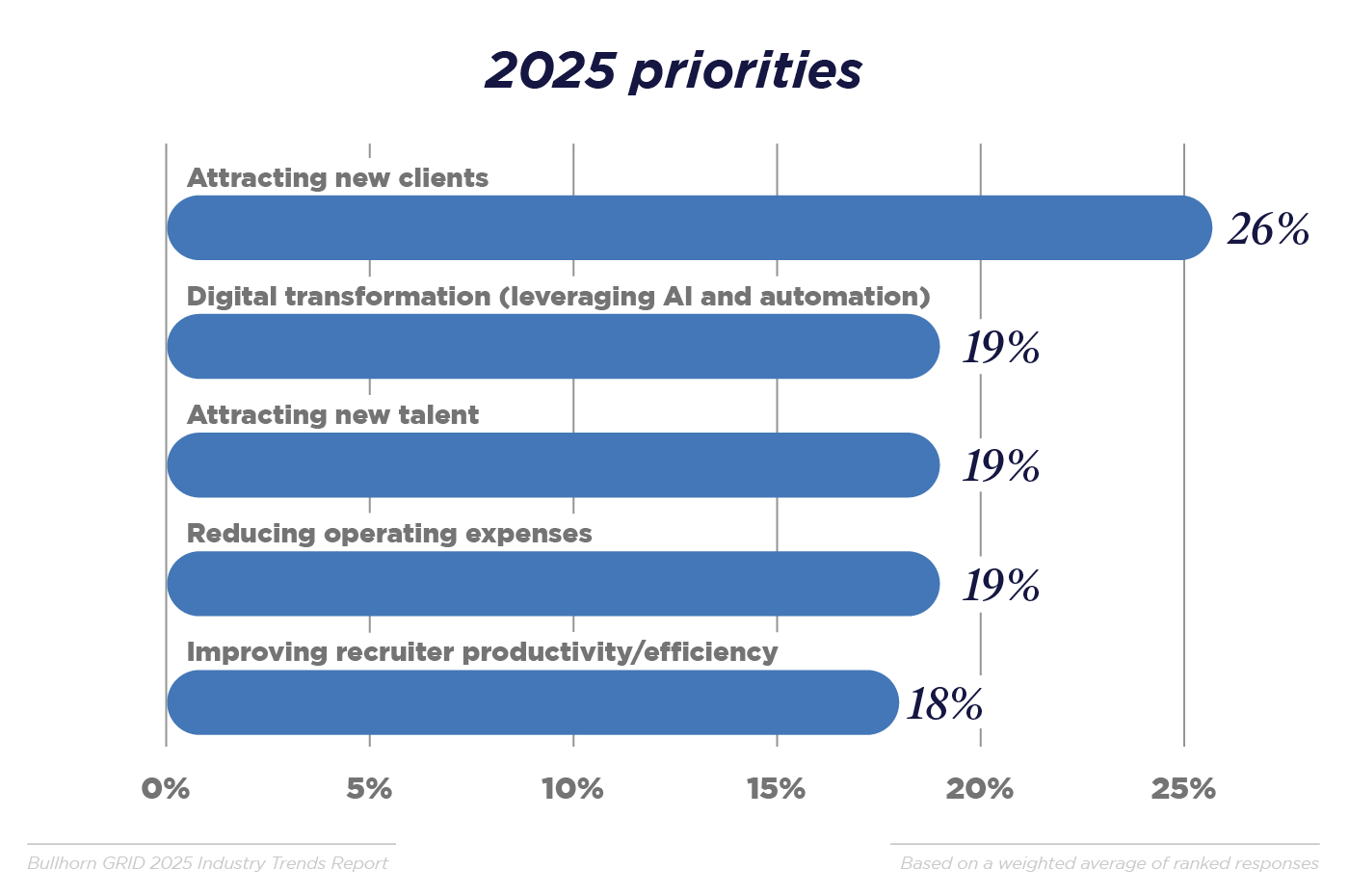

Given the potential for a new reality, it is worth looking at how firms are positioning their businesses for success while facing an uncertain future. Although attracting new clients is the number one priority across the board for 2025, firms have learned they cannot rely solely on revenue from new clients to drive performance; they need to find other ways to add value through new solutions and services. 73% are focused on increasing market share to be well positioned when the market turns upward. The next most popular strategy for driving financial performance is using technology to uplevel recruiter performance. This is not surprising given the crucial need in the light industrial space to focus on volume and speed — this is how firms are protecting both their top and bottom lines in spite of market uncertainty.

Key insights

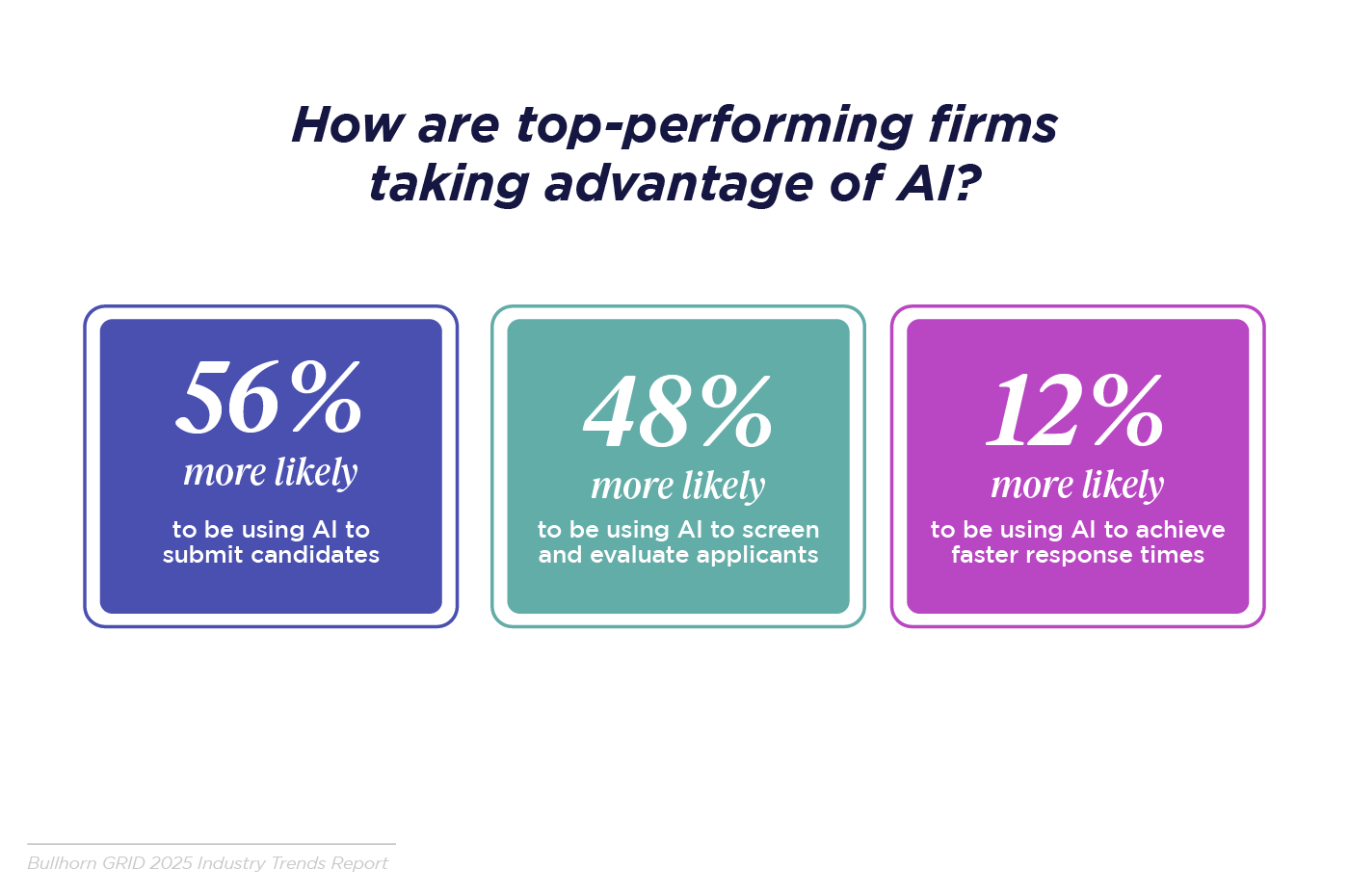

The 2025 GRID Industry Trends Report found that the most successful firms took advantage of their existing resources, doing more with what they already have. In particular, a few common strategies differentiated them from the rest of the market:

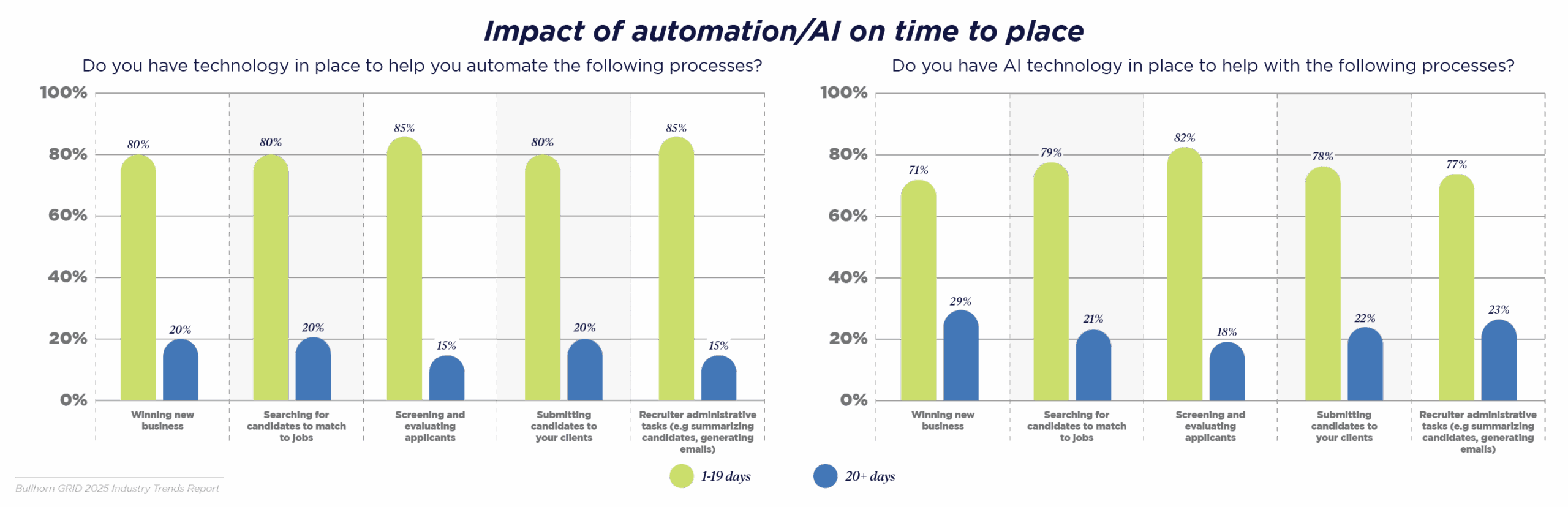

Upgrading automation across the entire workflow to enhance recruiter efficiency

Deploying AI throughout their business

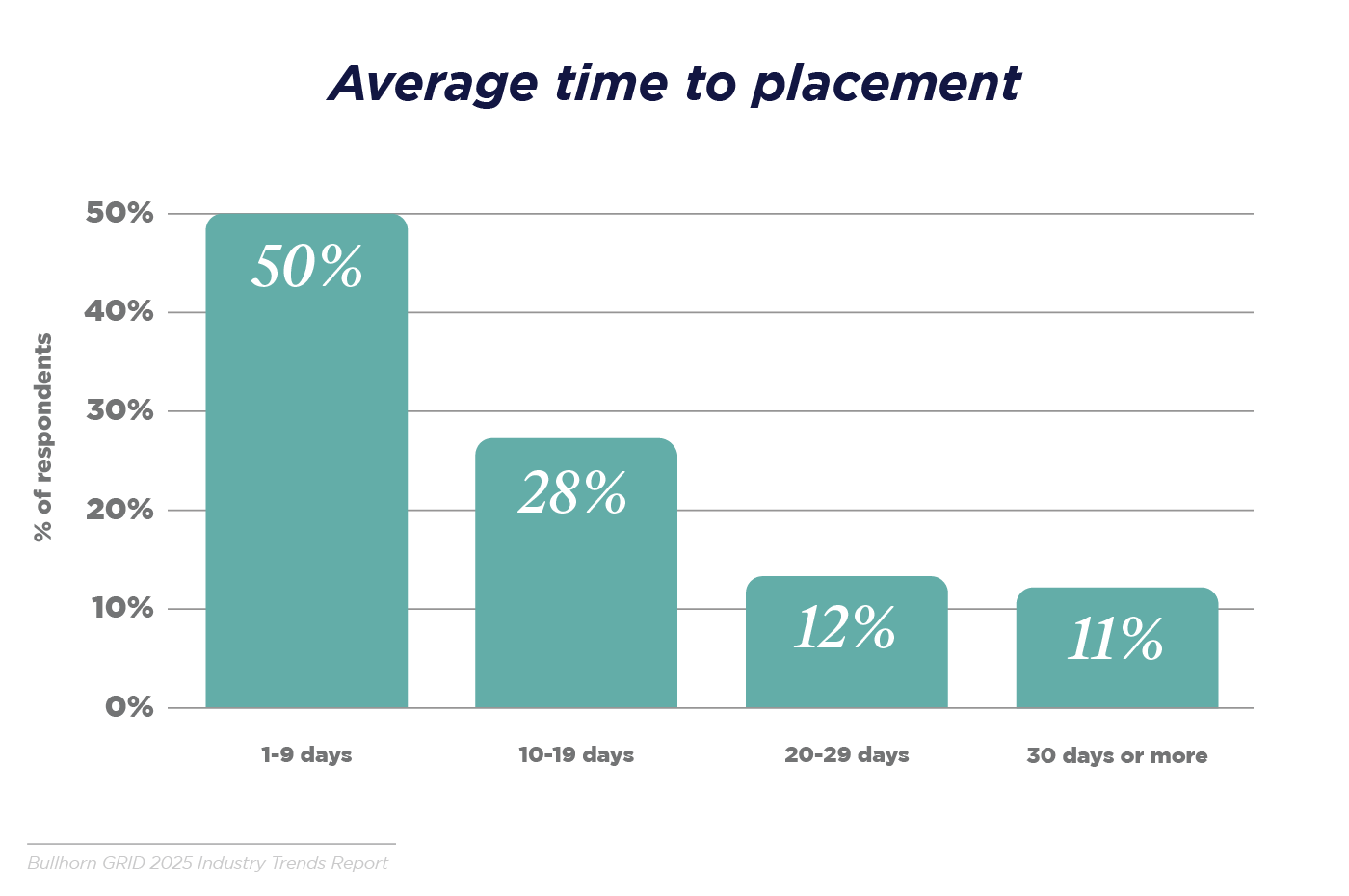

Delighting talent with faster, more accurate placement

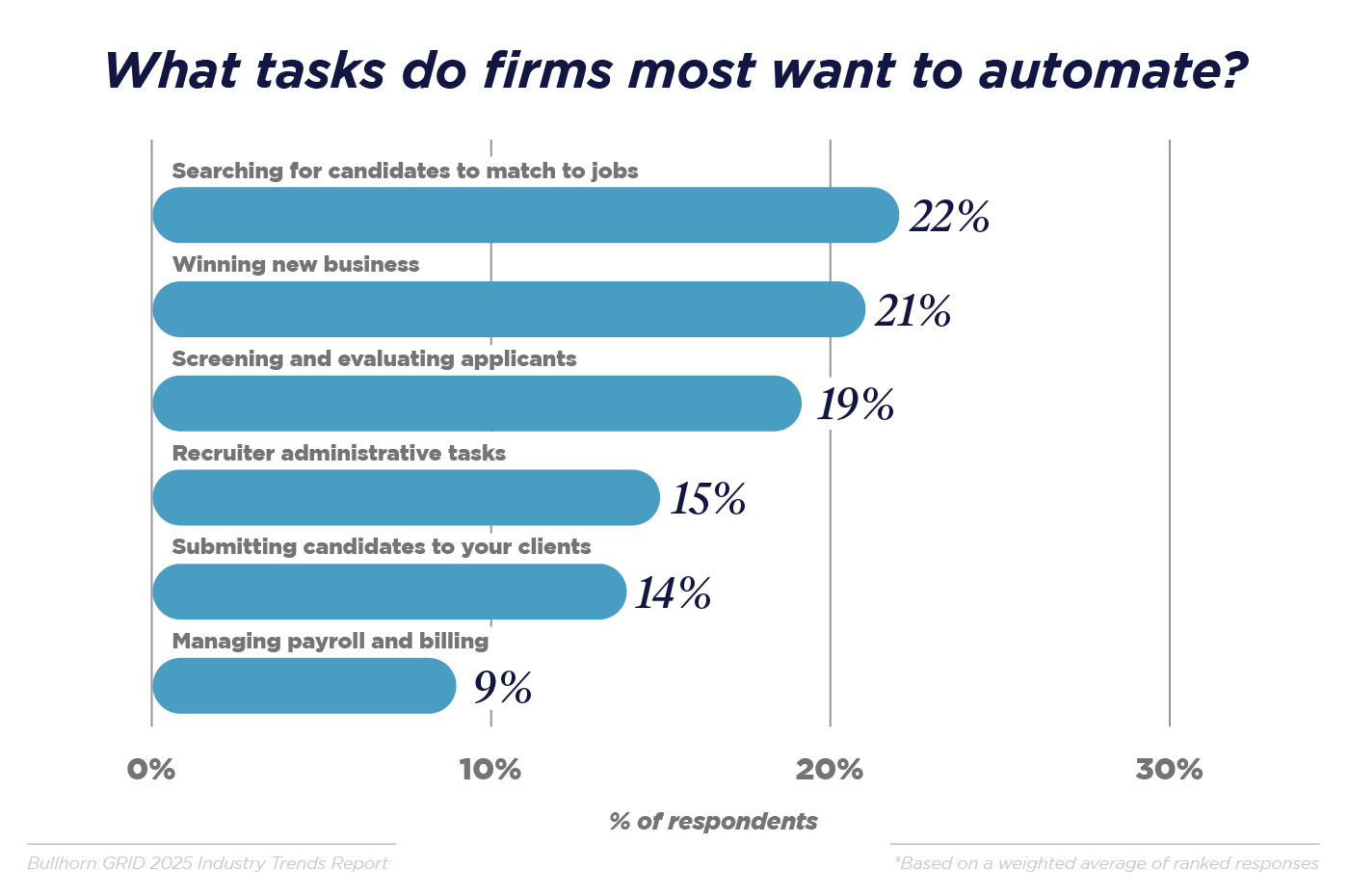

Search and match tops the automation wishlist

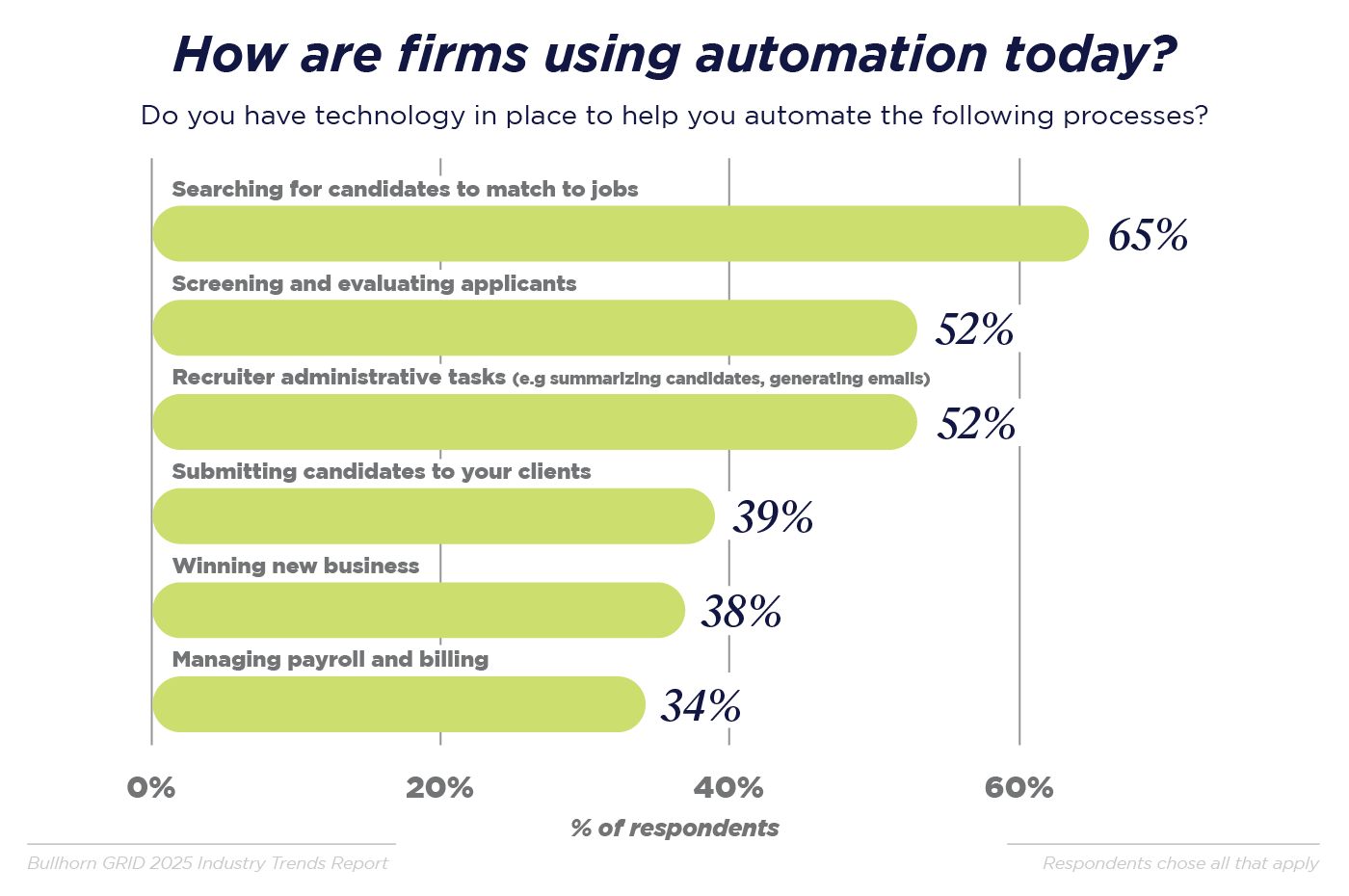

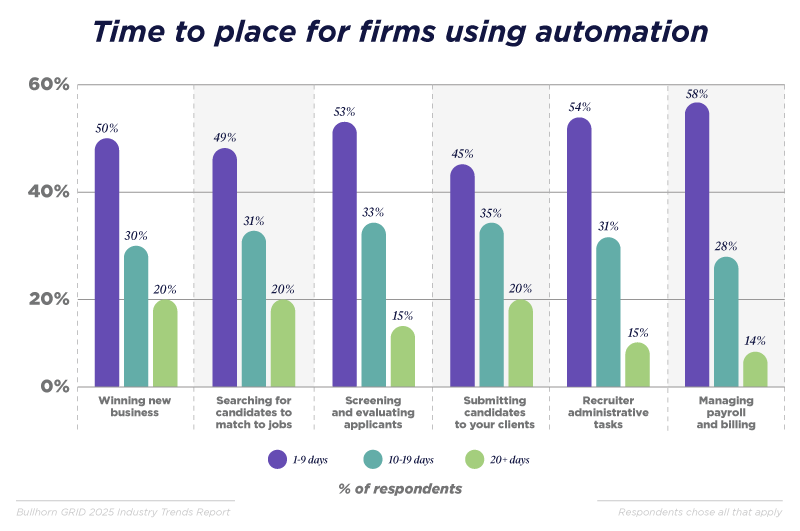

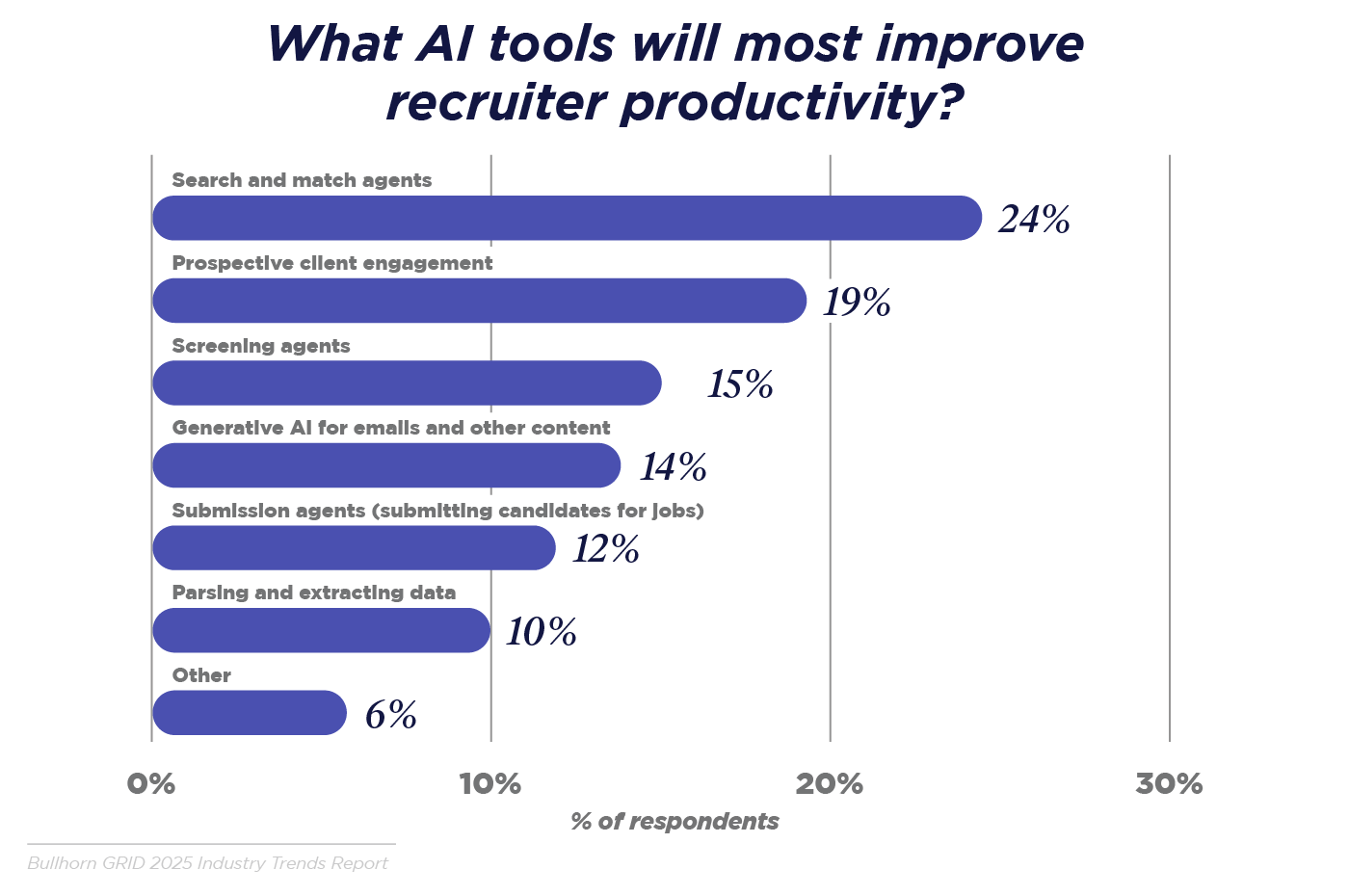

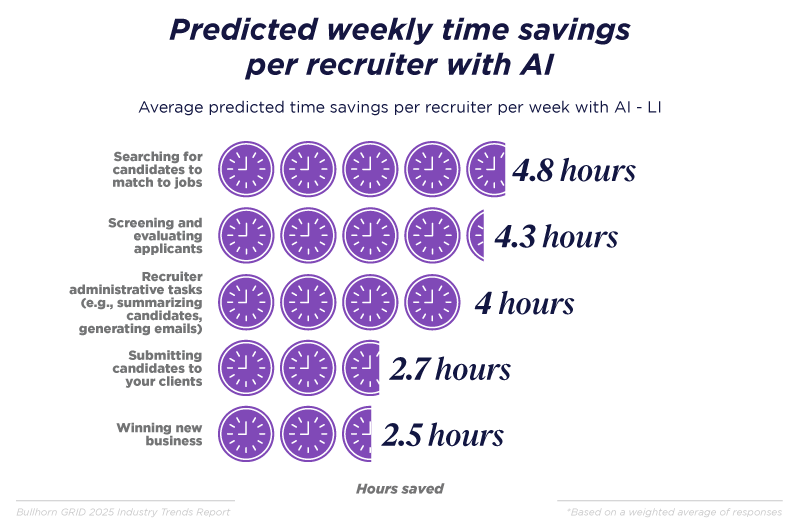

When asked to rank which of their day-to-day processes they would most like to automate, firms chose searching for candidates and matching them to jobs. A close second was winning new business — this is not surprising given the current market and what respondents said about their priorities for 2025. Across the recruitment industry, search and match is largely seen as the most valuable use case for both automation and AI. Again, this is not surprising since respondents also list this as the most time-consuming task performed by their recruiters; the survey found that a recruiter spends 14.8 hours per week searching for the right candidates, based on a weighted average of the survey responses.

Firms are clear that AI must enhance, not replace, the human aspect of recruitment

A recurring theme across all our conversations with recruitment executives this year was the importance of balancing technology with the human touch and specialized expertise. Several of the executives we spoke with made it clear that, in order for AI to work for them, it would have to be highly customizable and trained on their data, allowing each firm to leverage its own “secret sauce,” while accelerating and streamlining their workflows. Additionally, everyone was clear that AI is a tool to speed up how quickly recruiters can connect with the right candidates, so they can focus on the relational work that made them want to join this industry in the first place, preserving the differentiator that really attracts and engages talent for the long run.

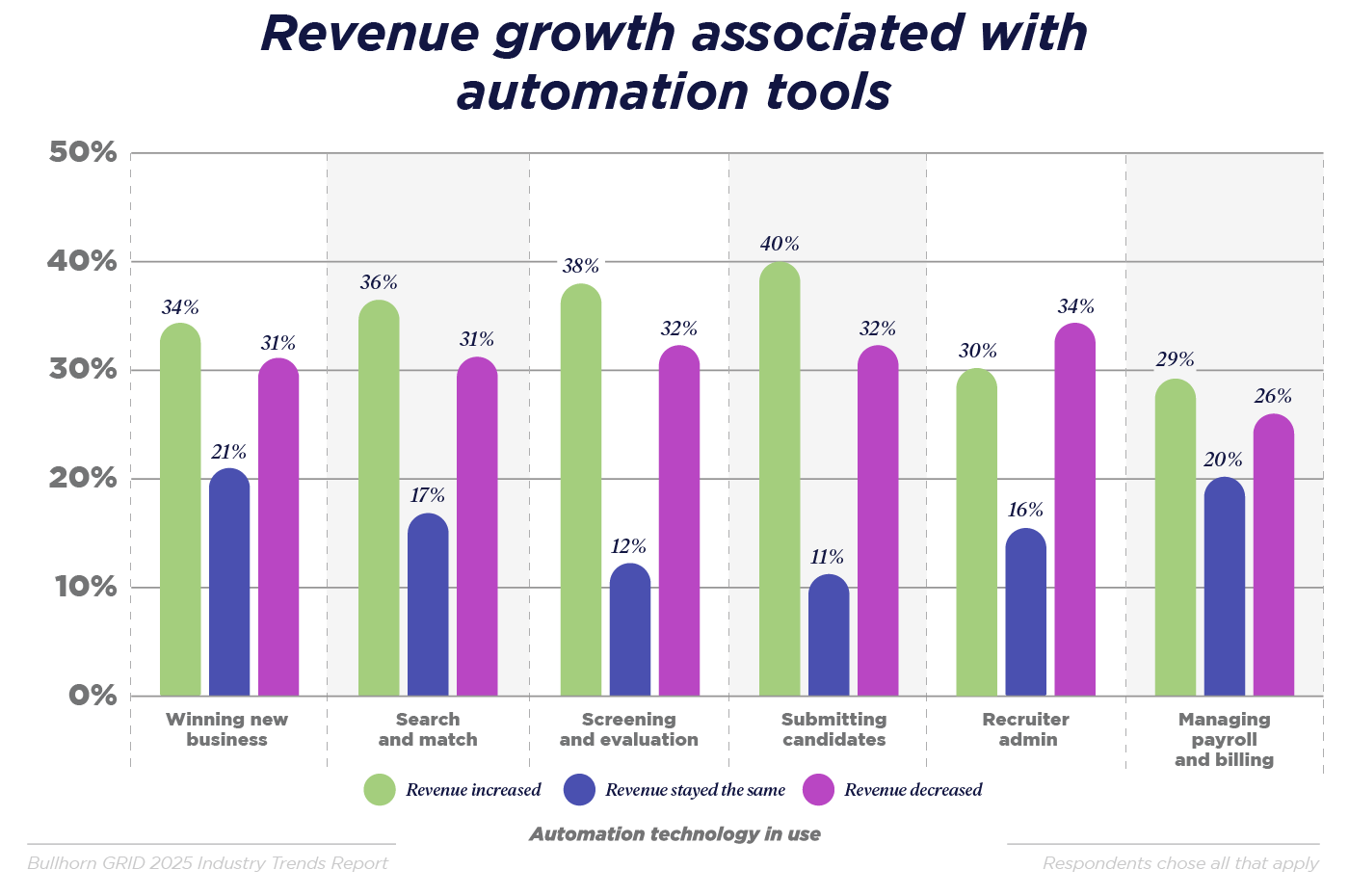

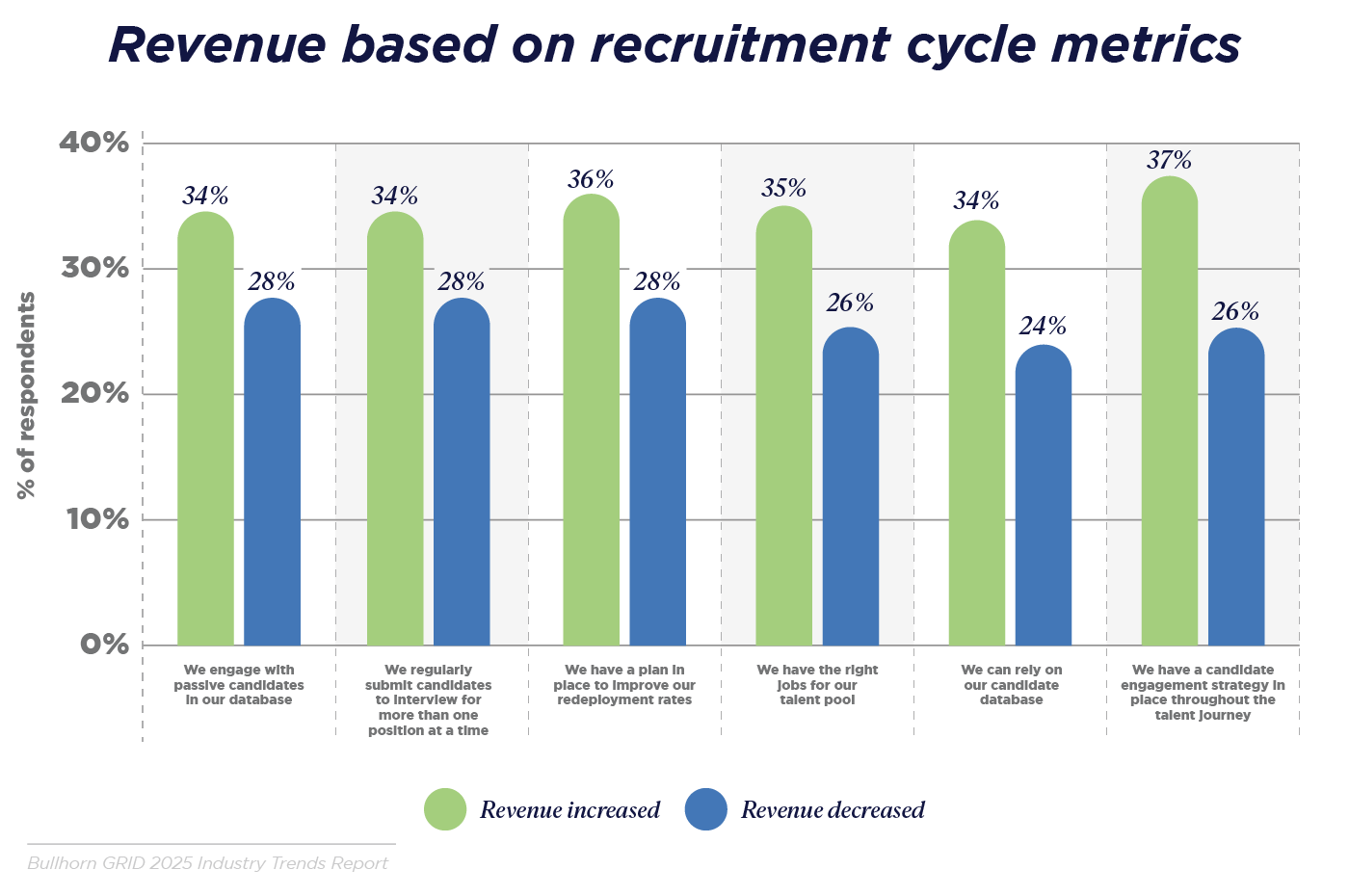

Firms that delight talent throughout the cycle are twice as likely to see higher revenue

Engaging candidates, having the right job matches, and readily redeploying top candidates clearly result in satisfied talent, but also yield decisive revenue gains. In every category, these engagement and productivity strategies make significantly more likely that firms saw revenue gains in 2024 — sometimes as much as 40% more likely. The win-win is clear — and AI agents are just going to make these gains even easier to achieve.

Attracting new clients remains top of the list

As has been true for the past two years, the top 2025 priority for a quarter of firms is attracting new clients, which is not surprising as the recruitment industry seems to be plateauing at a lower level than a few years ago. The next two priorities also remained the same as in 2024: attracting new talent and digital transformation. As we have seen in the rest of this report, AI and automation remain some of the best ways to achieve these goals.

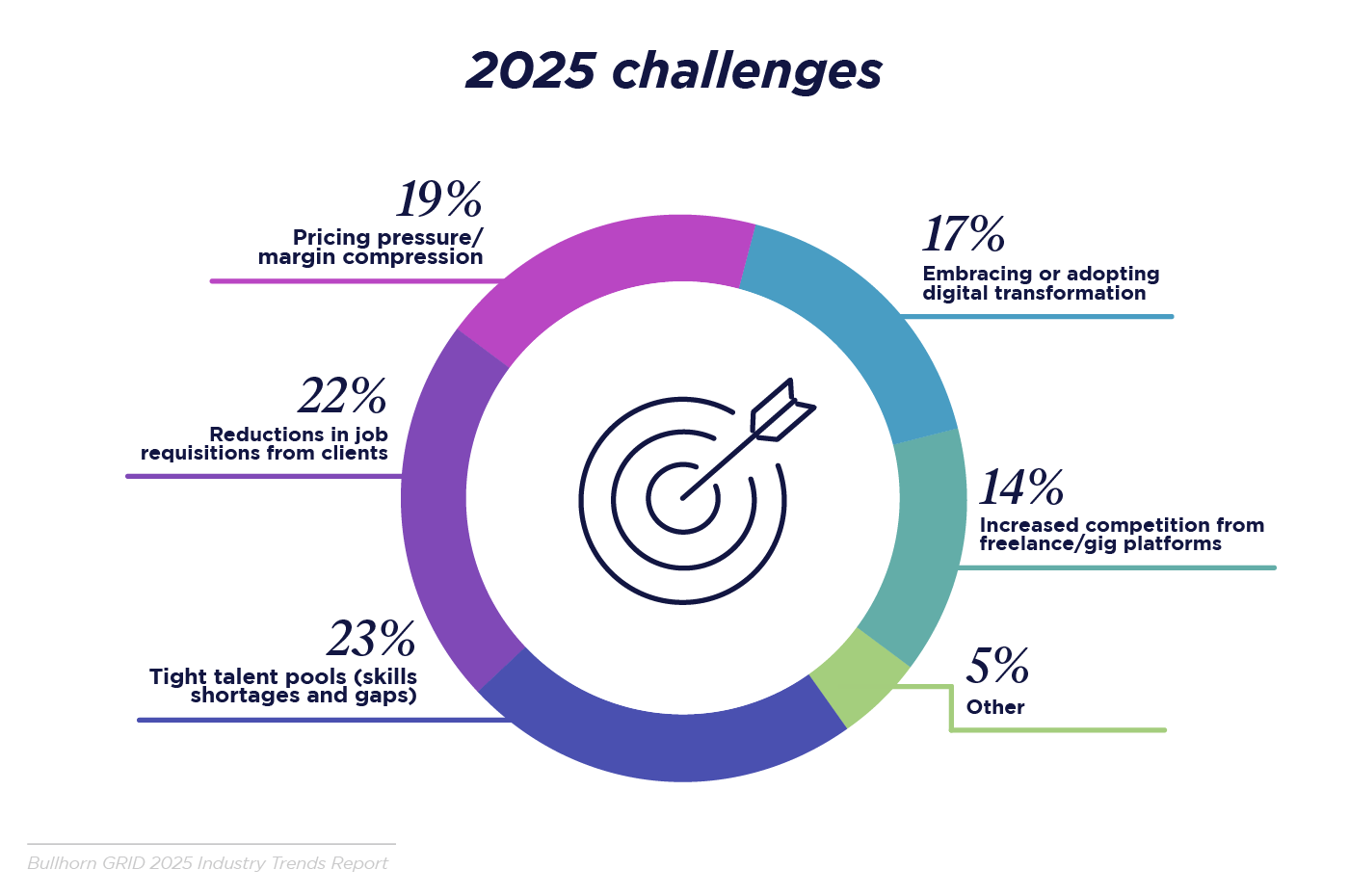

Tight talent pools remains highest concern in spite of fewer jobs

Falling job volumes and tight talent pools tied for the top challenges facing light industrial recruiting in 2025 — an apparent contradiction that has persisted for two years now. Even in the face of fewer job requisitions, there are still not enough candidates with the right set of skills to fill the jobs that are out there. This market context, which includes significant pricing pressure from clients, makes it even more important for firms to rely on technology to achieve the productivity and efficiency recommended in the rest of this report, especially when it comes to placing unskilled commercial workers.