Cautious optimism for 2024 against challenging economic backdrop

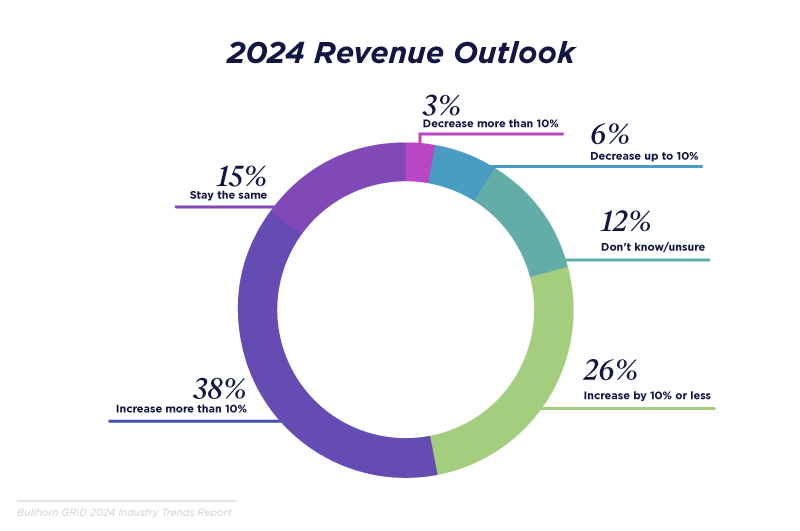

But there is cautious optimism amongst healthcare staffing firms as they look ahead to the remainder of 2024, with almost two-thirds predicting revenue growth this year.

As firms predict growth in 2024, they are planning for increased investments in infrastructure and staff. 36% say they plan to increase overall operating budgets in 2024, and 41% plan to increase their technology investments.

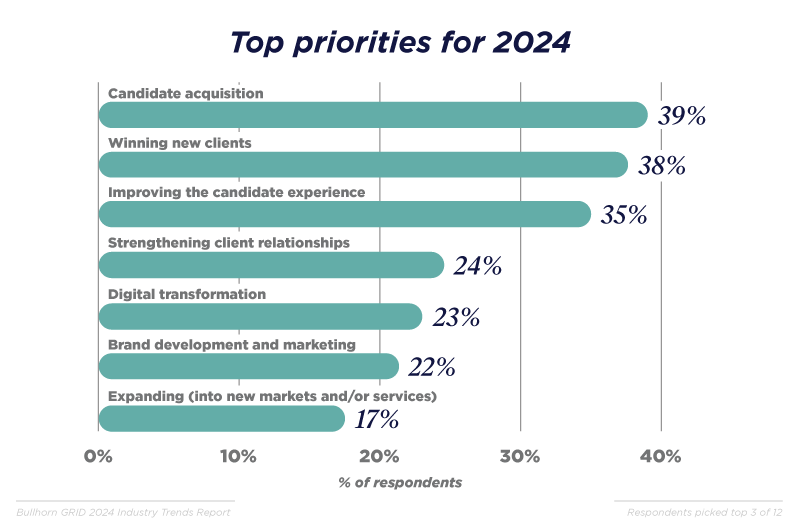

Firms remain focused on both clients and candidates

For most firms, relationships with both clients and candidates topped the list of firms’ business priorities. This included both attracting new clients and strengthening relationships with current ones. For candidates, this meant both attracting new candidates and retaining talent by enhancing the candidate experience.

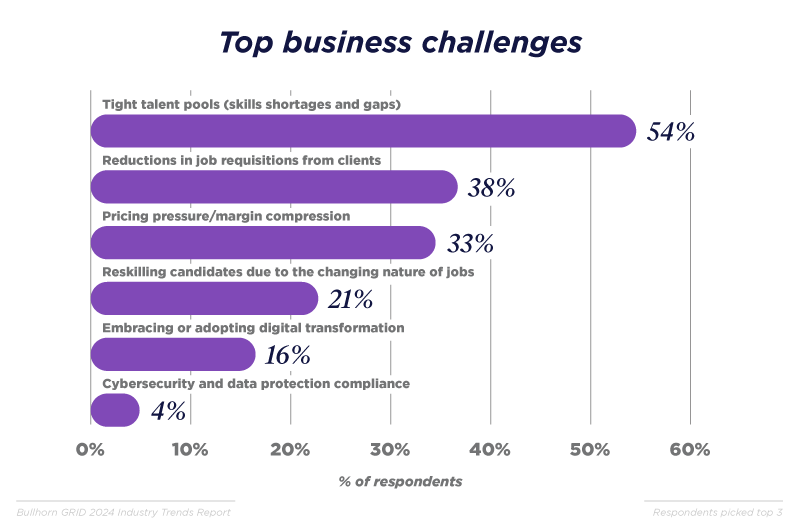

Tight healthcare talent pools remains a top concern

Compared to the rest of the staffing industry, healthcare staffing is facing a more extreme labor shortage — 54% of healthcare firms cite tight talent pools as a top concern compared with 42% across all other industries. Many healthcare staffing firms have been experiencing greater pricing pressure, especially lingering high wage expectations set during the COVID-19 period, and many healthcare facilities are trying to reduce staffing costs to stay afloat.

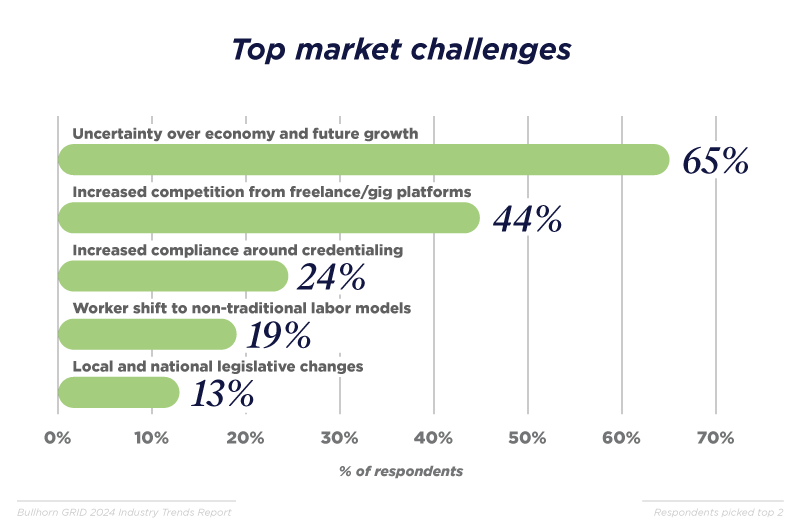

Temp staffing platforms are an increasing concern

It is not surprising that firms believe the top market challenge to be the overall economic outlook for 2024. What is surprising is that 44% of firms are concerned about increased competition from temporary staffing platforms — up from just 12.5% last year. This signifies a major shift in the market with these platforms holding 22% of the market today. It is increasingly clear that firms need to be offering self-service and other platform tools to remain competitive with candidates.

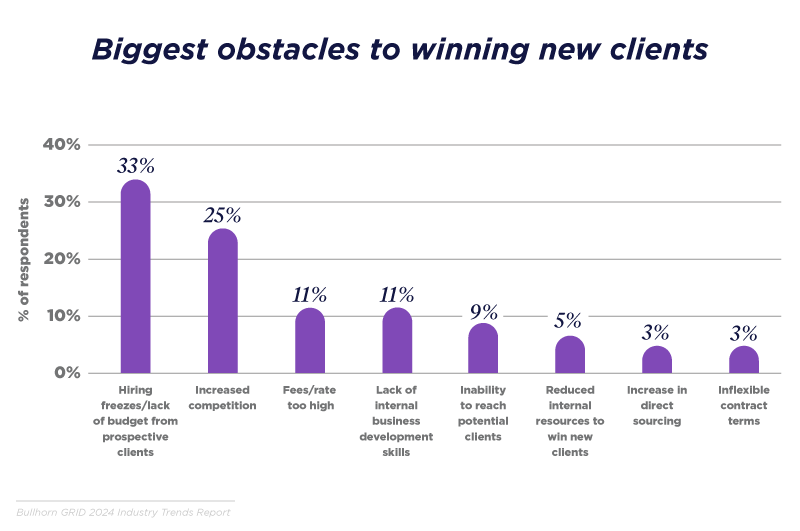

Hiring freezes and competition make winning new business an uphill battle

Firms report that hiring freezes were a big roadblock in 2023. As the economy worsened in 2023, many large healthcare organizations pressed pause on hiring as they examined their reliance on contingent workers. Most seem to have stabilized their contingent to permanent ratios and are likely to return to hiring, especially as healthcare utilization is expected to increase in 2024. And many healthcare staffing firms are feeling the pressure of increased competition, particularly as more gig options tempt candidates in the already tight labor pool.

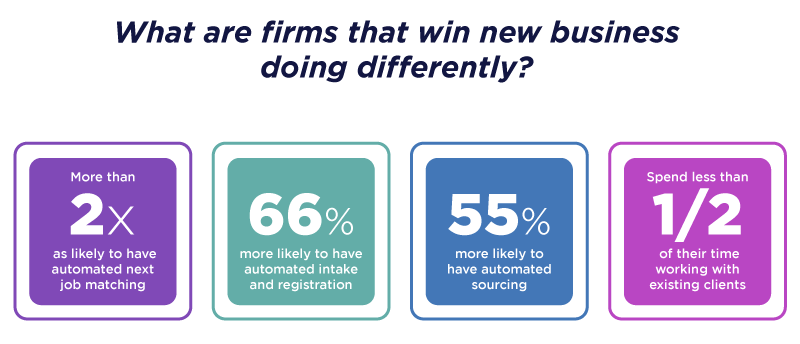

Automating key tasks makes firms more competitive

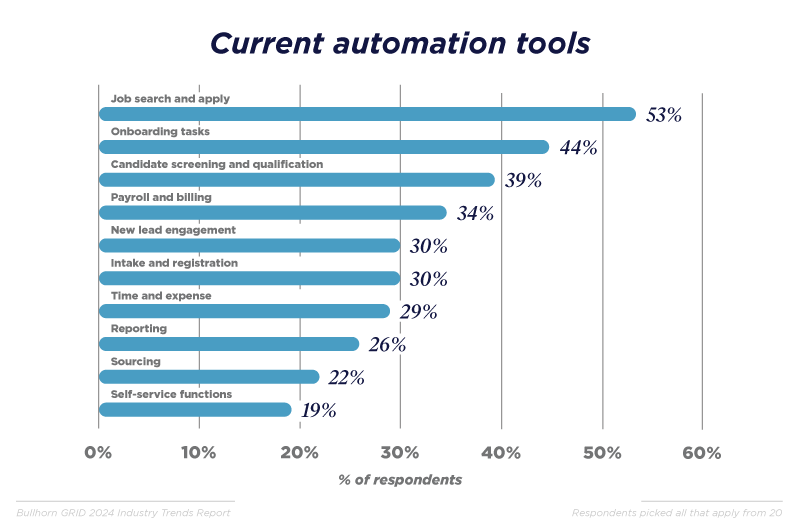

Firms that rated their success at winning new business as excellent or good were doing a few things differently when compared to those with poor success in this area. They automated some key tasks that allow them to match better candidates and move them through the funnel more quickly. They also used these tools to free recruiters up to focus on new clients while still supporting their existing ones.

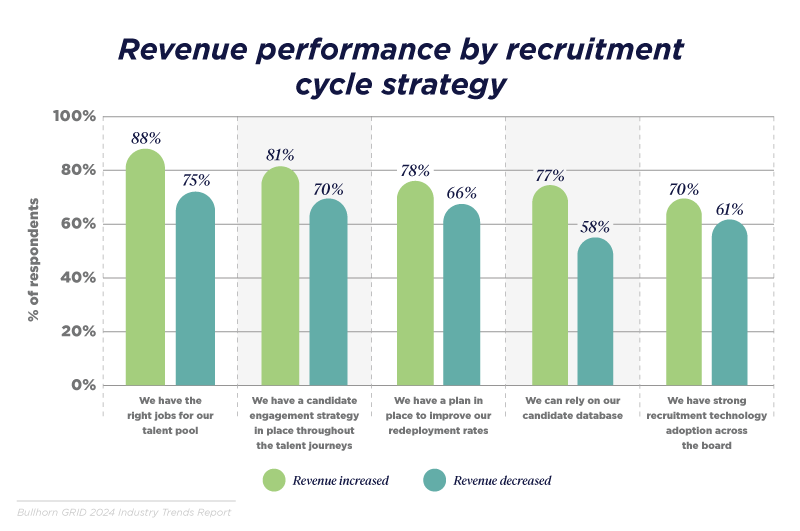

Top-performing firms can rely on their databases and know they have the right jobs for those candidates

Looking across the recruitment cycle, it is clear that all stages matter when it comes to revenue performance. But a few items do stand out: firms that gained revenue in spite of the tough economy in 2023 were highly efficient and really focused on being as productive as possible when it came to taking advantage of their databases. These firms were 34% more likely to say they could rely on their databases and 18% more likely to say they had the right jobs for their talent. They were also 19% more likely to have a clear redeployment strategy.

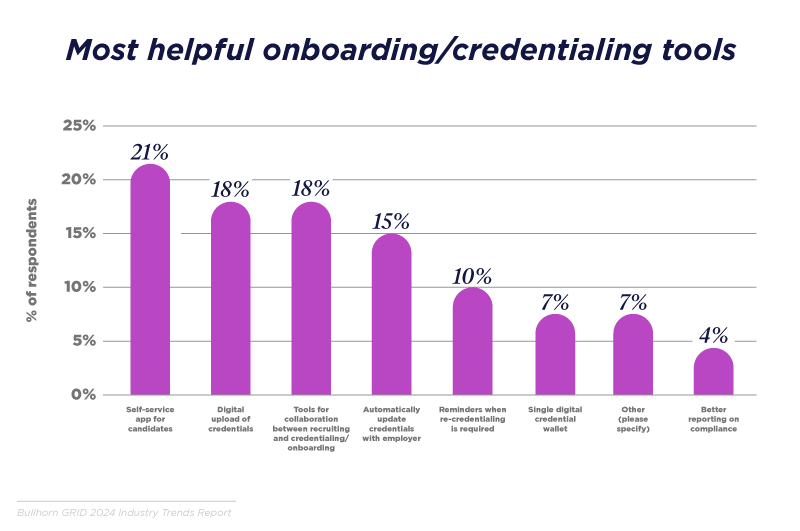

Accelerating credentialing and onboarding can improve efficiency

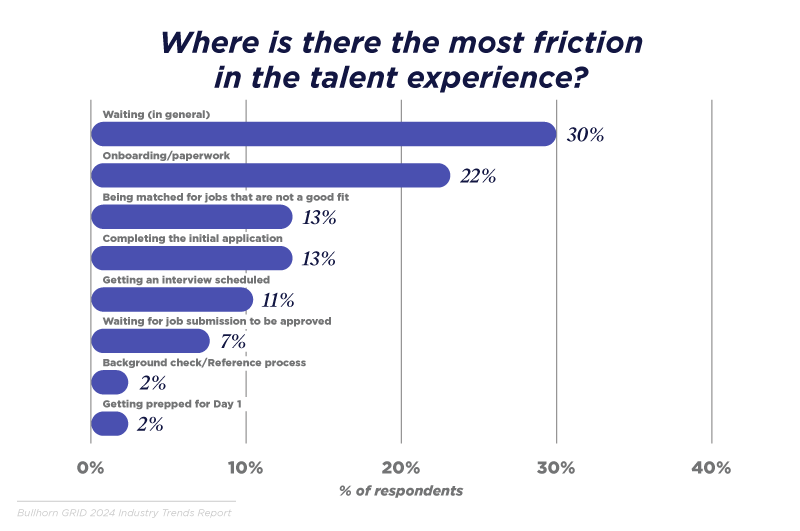

One of the biggest pain points for contingent healthcare workers is credentialing and other onboarding paperwork. When asked what tools would be the most helpful in smoothing out this part of the process, firms focused on tools to allow candidates to easily upload their credentials and keep recruiters up to date on their onboarding progress.

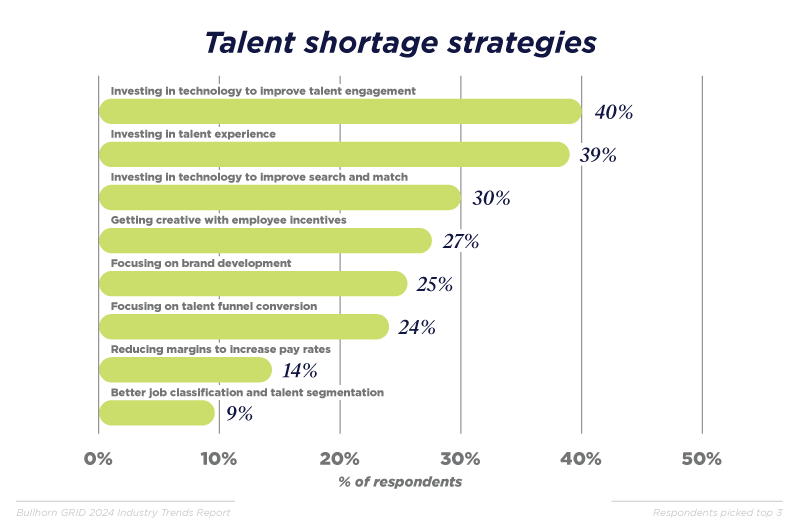

Firms are laser-focused on curating the talent experience and speeding up placement

Firms are investing in technology that improves the accuracy and speed with which candidates are matched to jobs as well as investing in tools to keep candidates actively engaged with recruiters. They are banking on these talent experience improvements to differentiate them from other firms and keep the best candidates active in their database.

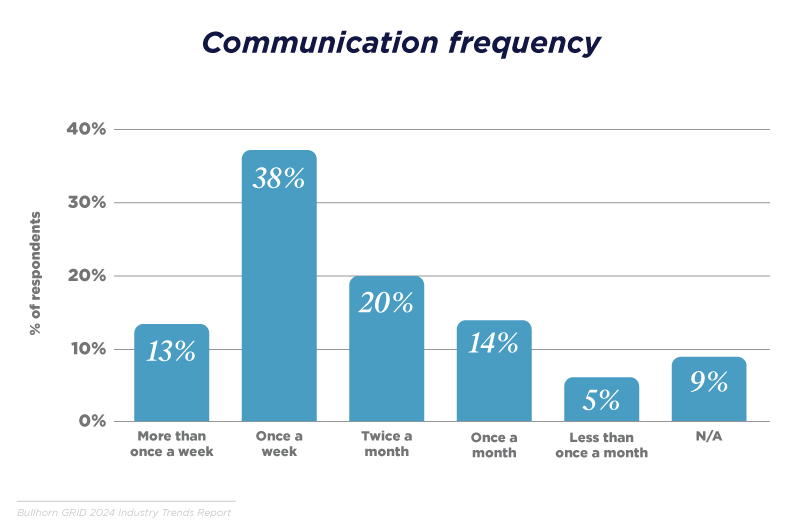

And firms are communicating with candidates frequently — but there is room for improvement

When asked how often they reach out to candidates on assignment, just over half indicated they communicate with candidates once a week or more. This is an important benchmark since the GRID 2023 Talent Report found that ¾ of candidates will continue working with a firm if they get weekly communication from recruiters.

Wasted time and rote tasks cause the most friction for candidates

When asked about the biggest pain points in the talent experience, 30% of firms said waiting — presumably waiting for paperwork, waiting for responses, waiting for interviews to be scheduled, and more. Waiting takes a huge toll on productivity and can be greatly improved by deploying automation tools. Additionally, firms cite rote tasks like onboarding and applications as bottlenecks. These are perfect candidates for emerging AI technology tools.

A lot of potential use cases for automation remain

Top automation tools currently used by firms include job search, onboarding tasks, candidate screening, and payroll/billing. But only one of these was being consistently used by more than half of the healthcare staffing firms surveyed. That represents a significant opportunity for savvy firms to lean into automation to differentiate themselves, especially when the analysis above shows how much of an impact automation can have on financial performance, winning new business, and improving the talent experience.

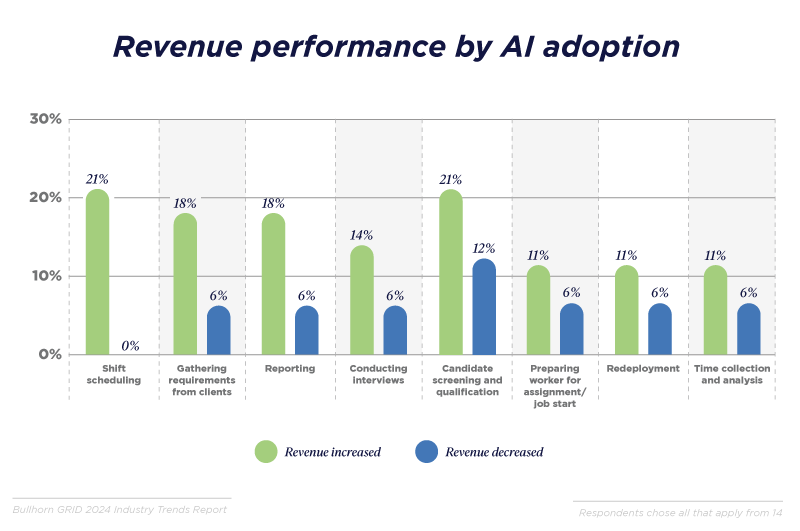

Early adopters of AI see significant revenue advantage

Although AI technology is new and healthcare staffing firms are not as far along in their adoption as some other verticals, the top-performing ones are making bold, early bets on the emerging technology. Firms that say they are using AI for gathering client requirements were 3 times as likely to report revenue growth in 2023. These revenue winners were almost 3 times as likely to be using AI for reporting, and more than 75% more likely to be exploring AI for candidate screening, redeployment, and time collection.